This morning American Express is launching a new deals platform in partnership with Facebook that should make big waves in the payments and offers space.

Winners: Facebook, American Express, small businesses

Losers: Groupon, LivingSocial, Google, foursquare, VISA, MasterCard

With the new platform, merchants will be able to target deals at American Express cardholders on the Facebook platform. Initial launch partners include H&M, Sports Authority, Dunkin’ Donuts, Sheraton, Westin, Travelocity and Celebrity Cruises. Although the launch focus is on big national brands, the platform is self-serve and well suited to the needs of small business. This presents a big and credible threat to Groupon, LivingSocial, Google Offers and other daily deal providers.

The platform covers both one-time and loyalty offers. Some examples of the offers that could be presented:

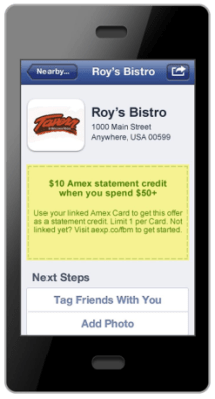

- Spend $30 and get a $10 statement credit.

- Spend $50 and get 10% back.

- Visit 3 times, spend $50 each time and get a $10 statement credit.

The offers work much like the recent foursquare and American Express deal: you link an American Express card to your Facebook account, select an offer to load it on your card and then pay using your AMEX. If you meet the offer criteria, you get the discount as a statement credit. This offers a significant benefit to retailers: no staff training required. Training has long been the bane of promotions and is often executed poorly. I recently spent 30 minutes at Radio Shack trying to redeem a foursquare offer. That’s a terrible experience for the consumer and the merchant.

For merchants, it also provides additional benefits over Groupon, Google Offers and LivingSocial. Ironically, the daily deals model is currently about as targeted as media that were available when AMEX was founded more than 160 years ago. For the most part, it’s at the region level (although it is moving towards a more geographically targeted approach). AMEX can do much better. This allows merchants to reach just the customers who are within their trade area, instead of offering deep discounts to deal seekers who come from 45 miles away and would never return at full price.

Merchants also benefit from analytics that AMEX can provide. Because it processes all of the transactions through its network, it can report on that data. AMEX captures important metrics like total spend. Tracking beyond initial sales of offers is another significant area where Groupon, Google Offers, and LivingSocial fall down.

In the future, I would look for AMEX to integrate this platform with transaction history data and its popular Membership Rewards program. With transaction history, merchants could better target cardmembers. Instead of sending out an offer to anyone in the city who wants a cheap massage, the offer could be sent to people within 5 miles who have shown a history of buying spa services and spend a lot of money each year. Membership Rewards integration could allow consumers to redeem points at any merchant on the American Express network, similar to the way in which consumers can redeem points for Amazon purchases.

The AMEX platform illustrates a big difference in business model. Groupon and other daily deal providers need to make their money on a one time deal with the merchant. As a result, in my opinion they’re doing a lot of deals that are bad for businesses. AMEX is forgoing that upfront revenue to build a long term relationship with the merchant that pays off over time. AMEX wins in three ways: driving traffic onto its network for existing merchants over VISA and Mastercard, providing a clear differentiator to encourage new merchant accounts and encouraging new cardholders. And the biggest difference of all: AmEx doesn’t take a 50 percent cut of each deal like Groupon does. It takes zero percent of the actual deal, and makes money instead through normal payment transaction fees.

The biggest question in my mind is how much marketing effort AMEX and Facebook will put behind this. The platform itself has the potential to become a serious Groupon competitor. But it needs marketing muscle behind it. If they don’t, it’s just another product announcement by a big company.

The AMEX/Facebook announcement also reinforces the folly that is Google’s bet on NFC. For some reason, Google is enamored with that technology. NFC is a solution in need of a problem. In the best case scenario, that investment will pay off in 3 to 5 years for Google. AMEX and Facebook are launching a product that works today.

The other big loser in this is foursquare. The announcement is pretty much the same thing that foursquare did with American Express. Except that in this case, it has the potential to reach more than 750 million unique users.