Salesforce reported earnings on Wednesday, and while it wasn’t quite the heady rush of last quarter’s unexpectedly strong offering, it was by all accounts decent. And as far as Wall Street is concerned, the numbers beat analyst’s expectations. Good on them, that always feels like a key investor metric when judging the quality of a quarter.

When you consider the stakes of the prior quarter, when activist investors were circling, the company did well enough to ease the pressure. Now it has to do everything else.

The company’s $8 billion in revenue certainly wasn’t anything to sneeze at. Salesforce grew 11%, down slightly from last quarter’s 14%. Overall, though, the numbers, if anything, look a little mixed with some good news and some not so good: Some parts of the business were growing quite slowly, and perhaps worse, continuing to decelerate.

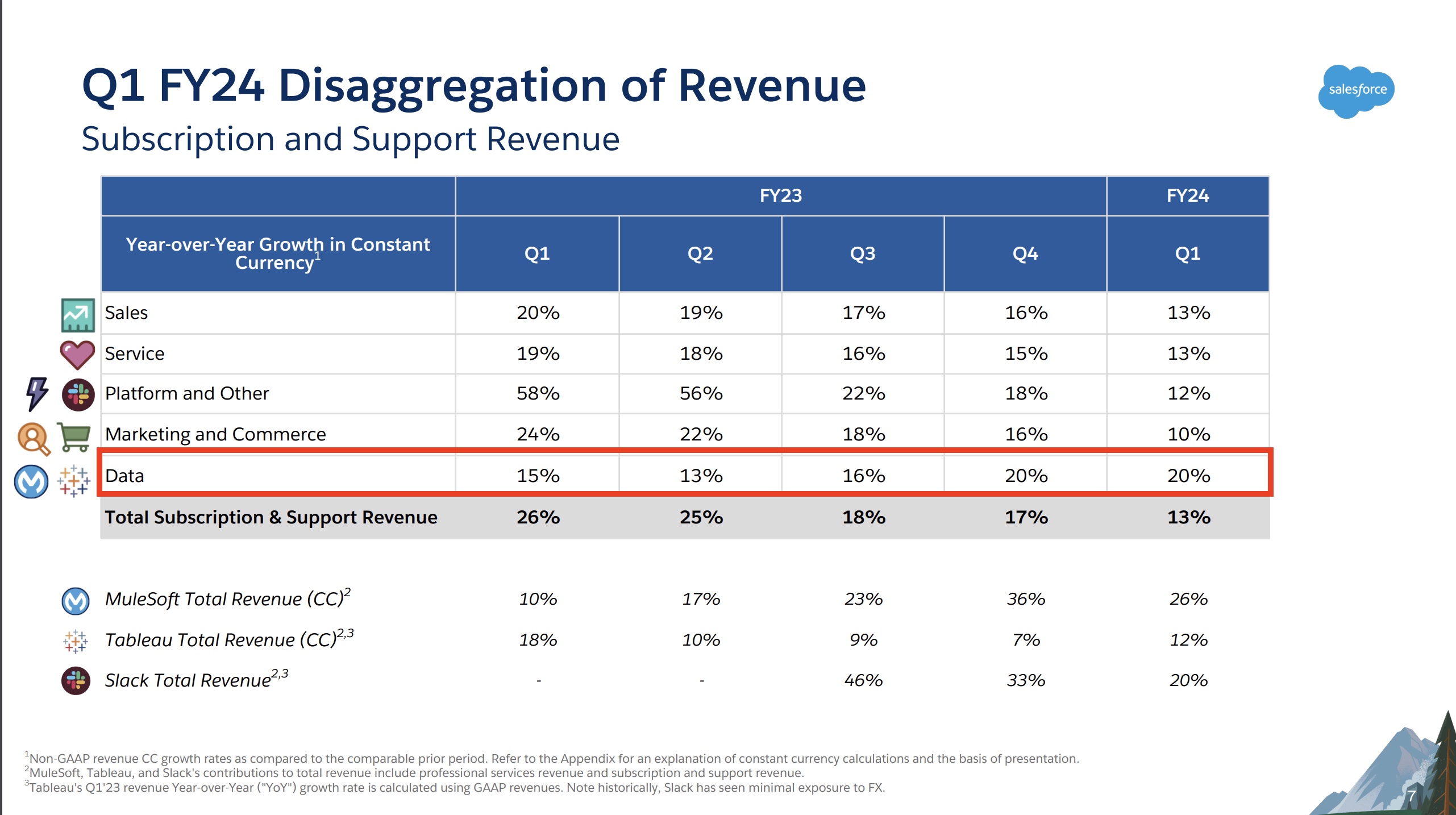

That said, however, perhaps one of the most interesting pieces of data in the financial report was which part of the company’s core offerings was actually the fastest growing cloud. Probably not the one you think. In fact, it was the newest one: Data Cloud, which launched last year at Dreamforce. (They called it Genie then, but as the company often does when it comes to product names, it changed the name a few months later to Data Cloud.)

Image Credits: Salesforce

Perhaps the fact it’s new could account for some of that growth since it’s always easier to grow faster when starting with a smaller number, but it could also signal a focus shift where the data exhaust being generated by the Salesforce family of products could become more valuable than the products themselves, at least in terms of new revenue adds.

At a recent customer event in New York last month, the company’s main keynote focused almost exclusively on generative AI, and that by using Salesforce data instead of the open internet, you could reduce some of the issues around hallucinations where the model makes things up, as well as data ownership and governance problems.

But before you can use that data in large language models, you have to process and manage it, and that’s where Data Cloud comes in. It’s a native data lake designed to work hand in glove with Salesforce’s various products.

Since that Data Cloud growth number caught our attention, we decided to dig into it a bit more to see how it fits in the overall report, and how Salesforce could use it to grow in the future.

Follow the data

The picture emerging from the enterprise push to bake generative AI into corporate software is one where data comprises a critical requirement, but also a competitive edge. TechCrunch+ recently looked at results from Salesforce, Box and CrowdStrike, noting that each company argued that the data they already control will help them provide more tailored AI solutions.

There’s good logic in that idea. In the case of Salesforce, it sits inside corporate sales, customer service and marketing, meaning that it has buckets of data from each of its customers. As AI models for the enterprise are likely best when tuned to constrained — which is to say, targeted and proprietary — datasets, it really could have an edge.

The fact that its data-focused work is already the fastest-growing portion of its key revenue drivers is a good indication that data is itself becoming an increasingly lucrative plank of the good ship Salesforce. With data forming the inputs that form AI brains, if you will, Salesforce is likely betting that its recently launched, and upcoming, AI products will help it keep growing.

Salesforce expects revenue growth of around 10% this year, a figure that is razor close to single digits. While some analysts told TechCrunch+ that they consider Salesforce’s guidance to be conservative, the company could use a shot in the arm to help ensure that it stays in the realm of double-digit year-over-year growth rates.

The company is certainly bullish on new AI technologies, with CEO Marc Benioff stating during its recent earnings call that his industry is “about to enter an unbelievable supercycle,” where generative AI and related tools will go down as the “technology of this lifetime, [and] maybe any lifetime.”

Given the dragon’s hoard of data that Salesforce sits atop, the prediction may bear out for the company. It has seen its revenue growth decline in recent years — partially engendering its recent scrap with activist investors — so it is likely looking for a new path to not only adding new customers but also to selling its existing roster more services.

Don’t think that our headline is hyperbole. It isn’t. Benioff said later in the same call that new AI tools are “an opportunity to transform” Salesforce itself, just as he expects that everyone else will have the same chance. We could be on the threshold of a new chapter in enterprise software of all types, as previously static software becomes more of a thinking assistant.

A lot of data crossed with recently developed AI tools could become the new enterprise software moat: The more data you have, the more value you can extract from it and offer — for a fee — to customers. Enterprise software companies that lack similar data assets may find themselves forced to offer dumber, or simply less sophisticated AI tooling (or based on other data sources). If AI winds up being even half as transformative as expected, we could see a divergence in fate for all the enterprise software companies we cover month in and month out. Startups and majors alike, to be clear.

It’s a long road to go from SaaS pioneer to CRM giant to diversified cloud company, but at each point in its journey, Salesforce collected data. Now may be the time that all that work sees its return redouble.