Turning away from the public markets, IPOs, SPACs and Palantir for a moment, would you like to talk about startups again? I would.

This morning, I pored over venture capital funding patterns for wellness-focused startups. Broadly, according to a new report, these startups raised less money in the first half of 2020 than they did in the first two quarters of 2019. Deal volume fell from nearly 600 in H1 2019 to just under 500 in H1 2020, and dollars invested slipped from $6.1 billion to $4.6 billion in the same timeframe.

But, if we peer a bit deeper and look at the subcategories of wellness startups, interesting hotspots become clear.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Inside the subcategories of wellness startups that CB Insights dug through while compiling the dataset, some, like fitness tech and sleep tech, saw fewer deals and dollars than they did in the first half of 2019. But one particular varietal is doing very well this year: mental health-focused companies.

The strong venture results that these startups have recorded in 2020 are not entirely due to a pandemic, a recession and political unrest that’s causing more anguish than usual, though I’d be surprised if those factors didn’t provide a tailwind of sorts.

The strong venture results that these startups have recorded in 2020 are not entirely due to a pandemic, a recession and political unrest that’s causing more anguish than usual, though I’d be surprised if those factors didn’t provide a tailwind of sorts.

Stepping back a few quarters, there’s a bit more to the business side of mental health startups that I want to unpack.

This morning, let’s remind ourselves about how startups like Calm and Headspace proved that their market was large and lucrative, review the venture capital data and see if the pattern of strong investment in the space is continuing in the current quarter.

We should see another unicorn or two out of the group, we reckon, before the eventual tech downturn. So let’s work to understand where the category is today.

One reason why VCs like mental health startups

Money. That’s the main reason.

Venture capitalists don’t want to invest in slow-growth businesses, even when they are nicely profitable. The industry pejorative “lifestyle business” is thrown around to describe companies that don’t have rocket-like growth trajectories.

But some mental health-related startups have met the venture growth threshold, most notably, Calm and Headspace. In mid-2018, Headspace was reported to have generated $9.3 million in Q2 revenue, with that tally rising 50% year-over-year. In early 2019, Calm raised $88 million at a unicorn valuation after quadrupling its revenue in 2018 and reaching a $150 million run rate that year.

More recently, Sensor Tower data reported in early 2020 indicated that the top 10 meditation apps had generated $195 million in 2019 revenue, though that number could be low given what we know about Calm’s scale in the year prior.

Regardless of the final, absolute figures, it’s generally agreed that there’s big money in the mental health space, given that the subcategory of mediation is itself booming.

Investors are putting dollars to work in 2020 to further the growth mental health startups managed in 2018 and 2019. Per the CB Insights dataset, in Q1 and Q2 2020, these startups saw 106 rounds worth $1.08 billion. In the year-ago period, the figures were 87 rounds worth $750 million. (Unlike some subcategories of wellness startups that CB Insights detailed, mental health upstarts have enough regular VC volume to make year-over-year comparisons reasonable.)

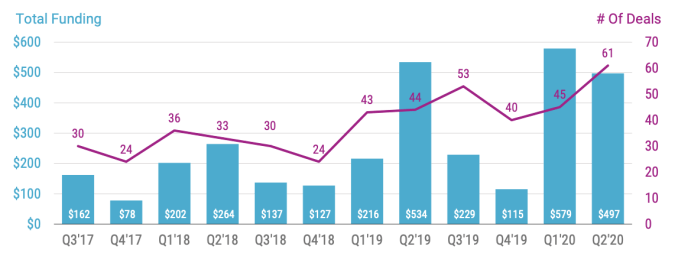

Here’s what the chart looks like, to give you a taste of the data over a longer time horizon:

Image Credits: Via CB Insights, shared with permission

The above chart includes remote-therapy services, meditation, virtual coaching and services that help alleviate anxiety and related issues. It shows a nicely positive trend, even if Q2 2020 dollar volume was modestly down from Q1 2020 and Q2 2019 results.

Digging into the venture results — and comparing Crunchbase data and the report — some rounds that stood out from the start of 2020 include Mindstrong’s $100 million round from May and Headspace’s recent $47.7 million Series C extension. The company has raised equity twice and debt once this year, it appears.

Outside the H1 2020 timeframe, more money is flowing. Heal, a platform that offers telepsychology services, raised $100 million in July, for example. So, perhaps Q3 will be another strong period for mental health startups.

Given that it wasn’t too long ago that even talking about mental health was taboo, seeing this level of financial wagering in favor of the startup niche is encouraging. Especially in today’s world, which has not proven conducive to great sleep and low stress in my personal experience.

If Q3 data for mental health startups stays strong, the budding trend that we are noting today will more resemble a boom in capital availability for startups that want to help our brains. And that’s cooler than more vertical SaaS companies raising another late-stage check.