Indonesia’s tech firm GoTo Group, which was formed last year via a merger between ride-hailing giant Gojek and marketplace Tokopedia, plans to raise at least $1.1 billion (15.2 trillion rupiah) from an Indonesia initial public offering (IPO) scheduled for 4 April.

GoTo says it aims to sell up to 52 billion new Series A shares at between 316 rupiah and 346 rupiah apiece, raising $28.8 billion at the top end of the range.

The move comes at a time of increased volatility for listings and amid the turmoil due to Russia’s invasion of Ukraine that rattles financial markets.

“Indonesia is one of the largest and most exciting growth markets in the world, as reflected in the resilience our capital market has shown this year, against the backdrop of global market volatility,” Andre Soelistyo, chief executive officer of GoTo, said in a statement. “Our listing will be a great moment for those involved in the success of our ecosystem and for everyone that believes in the Indonesian dream.”

The company raised more than $1.3 billion in its pre-IPO last year from investors including Abu Dhabi Investment Authority (ADIA), Google, SoftBank Group, Temasek, Tencent and Fidelity International.

In November, the company said it was planning dual listings in Jakarta and New York. GoTo did not immediately respond when asked about its U.S. IPO plan.

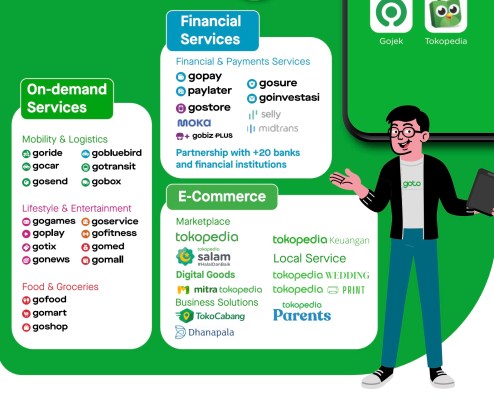

GoTo, which has three businesses (ride-hailing, e-commerce and financial services) under a single ecosystem, will use the IPO proceeds to support its growth strategy.

“The strength of our business is that we are more than the sum of our parts. Our ecosystem of on-demand, e-commerce and financial technology services connects millions of consumers, driver-partners and merchants, with the mission to empower progress for everyone in the fast-growing digital economy,” said Soelistyo.

The company says its e-commerce total addressable market (TAM) in Indonesia is expected to increase to approximately $137.5 billion in 2025 from $44.6 billion in 2020, while the financial technology TAM in the country is expected to grow to about $70.1 billion in 2025 from $17.8 billion in 2020.

GoTo posted gross transaction value (GTV) of $28.8 billion and gross revenue of $1 billion in the 12 months ended September.

GoTo has more than 2.5 million registered drivers and over 14 million registered merchants as of September 2021.