There’s one slide that almost every founder gets wrong when they are putting together a pitch deck to raise money from venture capitalists. The slide is usually known as “the ask,” and it typically lives toward the end of the pitch deck.

It is meant to do something pretty straightforward: Explain how much money a startup is raising and for what. It shouldn’t be rocket science, but it’s almost universally a struggle to get right.

Here are the most common mistakes:

- Forgetting to include the slide altogether.

- Not naming a specific dollar amount you are raising.

- Including a valuation on the slide.

- Omitting what the funds will be used for.

- Listing a specific runway, i.e., “This will keep us running for 18 to 24 months.”

Let’s explore in detail why these mistakes are so detrimental to your fundraising process and how you can best include these points in your deck.

Include the slide

Obviously, the easiest way to fail on this slide is to forget to include it altogether. That’s a mistake. The whole purpose of doing a fundraising process is to raise money, so you may as well go all-in with a clear ask.

Name a specific dollar amount

Quite a few founders I’ve worked with in my consulting practice as a pitch coach argue against including any amount at all. The logic, they argue, is that there are so many different ways to build the company. If they raise $3 million, they go down one path. If they are able to raise $5 million, they go down another. If the fundraising doesn’t go as smoothly as they hoped, and they’re only able to scrape together $1.5 million, they’ll make that work, too.

It’s good to be scrappy and adaptable as a founder, but you need a Plan A: What, in your opinion, is the right amount of money to raise to get the company to the next stage of growth and the next round of funding? Of course, it’s possible that your lead investor wants to push you toward raising more or less than that, but you need to have a solid picture of how you’re going to get from where you are today to where you want to go.

Don’t list a range. Don’t mention that you have 28 different plans for how to make your company successful. The investors are going to want to see that you can be decisive and strategic. Make your Plan A, stick a dollar amount on it, and put that dollar amount on your “ask” slide.

In other words: If you are raising a seed round now, think about what you need to prove to your investors to be able to raise a Series A next. Map all of that out and determine what resources you need to get there. That’s how much money you need if everything goes to plan. Add 30% to 70% as a safety buffer (depending on how good your planning is and how predictable your business is), and that’s how much money you need to raise.

Don’t include a valuation

Another common mistake I see is that founders include the terms of an investment, or the valuation, on a slide. If you put “raising $5 million at a $20 million valuation” on the slide before you have a lead investor, you’re making a mistake. You may have an opinion for what valuation you are hoping for, of course, but that will come out as part of the negotiation later on. The amount of money you need is fixed-ish; what you are willing to give up in order to raise those funds is not.

In the best-case scenario, you find two or three lead investors who end up in a bidding war for the privilege of investing in you. The levers they have available aren’t just the valuation of the company, of course — there are plenty of other clauses that are up for negotiation in a funding process.

The one exception to this is if you already have a lead investor and you’re just looking to close out the round. In that case, your “ask” slide can include the name of the lead investor and the terms agreed upon. “Raising $5 million at a $20 million valuation, and Investor X has committed $3 million of the round” can work. Having said that, if you’re that far into your funding round, there’s probably enough inertia to close out the round; it’s unlikely to be necessary to update this slide once you have a signed term sheet in hand.

How to respond when a VC asks about your startup’s valuation

Explain what the funds will be used for

You’re running a startup, and you’re going to want to raise money to accomplish something. Makes sense. What doesn’t make any sense at all is how many founders seem to be shy about sharing the details of the plan. A lot of the due diligence process is going to be focused on figuring out whether you are a competent, believable founder and showing that you have a detailed plan and vision for what’s going to happen over the next stretch of time.

Put differently: If I’m going to invest $2 million into your startup, I want to know what that money buys me, in terms of progress for your company.

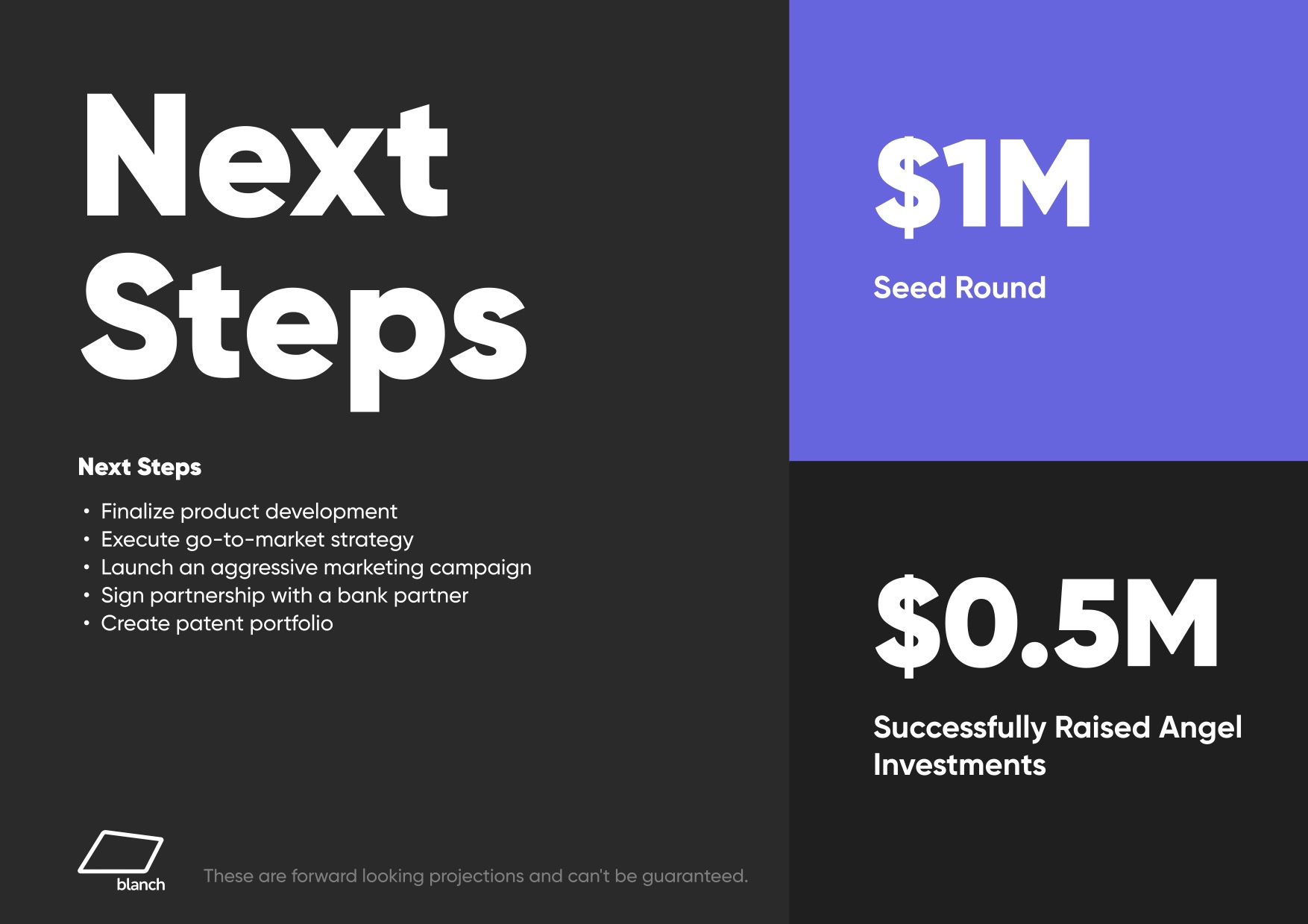

Ideally, your company has an operating plan as part of the pitch deck, which goes into detail about what is going to happen between this and the next funding round. On the “ask” slide, however, you have the opportunity to summarize in three or four bullet points what you’re going to do with the money.

Typically, you’re going to want to include product, traction, market validation and key hire milestones.

- Product — What product milestones do you need to hit in order to raise the next tranche of money? In particular, this includes beta or full product launches, major feature sets in the product pipeline or integrations with partners.

- Traction — What business metrics do you need to achieve in order to raise more money? How many units do you have to sell, how many subscribers do you need, how many customers do you want? Other metrics may also be helpful here — your net promoter score (NPS), monthly active users, etc.

- Market validation — What can you do to prove that there’s a real market out there willing to pay for the product or service you are peddling?

- Key hires — In order to reach the above goals, you probably need to hire. How many people do you need to hire? When?

Each of these goals should be SMART: specific, measurable, achievable, relevant and time-based. Poor goals are vague: “Improve marketing,” or “Get more customers” or “Add features to our product.”

Examples of great SMART goals:

- “By June 2023, we need 2,000 paying customers on our recurring subscription model.”

- “In the next six months, we need to reduce our customer acquisition cost by 20%.”

- “Our B2B sales need to improve, so by July we are aiming to hire an experienced VP of sales who can help shape our sales processes.”

Be. Specific.

Never mind the timeline — talk about the milestones

As we hinted at above, it’s important to list the milestones you believe you need to achieve in order to raise the next round of funding. Note that this is milestone driven; each goal unlocks the next part of the journey. But that doesn’t mean that you’re explicitly talking about time.

You are not raising money to get 18 months of runway. You are raising money to hit a certain set of milestones. If you can do that in 12 months, then you raise your next round of funding in a year. If you need 24 months, that’s OK, too. Don’t get too hung up on the timeline; some things take more time than you might expect. That makes sense; this is a startup — nothing ever goes to plan.

The corollary of this is that you need to bake enough wiggle room into your plans. If you expect something to take 18 months, but it takes 24, it’s a really poor look if you run out of money in month 19.

Clarity is crucial

The “ask” slide is one of the most painful slides to get wrong because it shows that you aren’t a very good founder. Perhaps you’re a great technical co-founder, a brilliant salesperson or an incredible marketer, and that’s great — but the job of the founder is to have a specific, actionable, reasonable plan in place to navigate through choppy waters.

Having a poor “ask and use of funds” slide is a huge red flag to many investors. After all, investors have a conga line of smart, talented folks coming through the door day in and day out.

To stand out, you can’t just be good at marketing, sales, development or any of the other aspects of running a business. You have to be good at the art of running the business, too — and this is one of the slides where you get to show off and prove that you know what you’re doing. Don’t waste that opportunity.

Comment