Melissa Wong spent more than a decade working for major retail brands before founding Retail Zipline. That kind of outrageous advantage — a complete understanding of the industry — is something that investors struggle to resist in a vertical SaaS company. At least, according to Emergence Capital investor Lotti Siniscalco.

Wong and Siniscalco joined us on a recent episode of Extra Crunch Live and went into detail on why Emergence was eager to finance Retail Zipline’s Series A round, walking us through Zipline’s Series A pitch deck and sharing which slides and bits clinched the deal.

Extra Crunch Live is a weekly virtual event series meant to help founders build better venture-backed businesses. We sit down with investors and the founders they finance to hear what brought them together, what they saw in each other and how they work together moving forward. We also host the ECL pitch-off, where founders in the audience can pitch their startups to our outstanding speakers.

Extra Crunch Live is accessible to everyone on a live basis, but the on-demand content is reserved exclusively for Extra Crunch members. You can check out the July slate here and see the full ECL library here.

Stand up, stand out

During Wong’s fundraising process, Zipline was also attending a big industry conference. Emergence suggested that they do a virtual pitch meeting while Wong was at the trade show, but Wong pushed back, insisting on an in-person pitch meeting. Not only did she know that she would deliver a better pitch in person, but she didn’t want to squander the limited amount of time she had at the trade show with potential clients and partners.

“She pointed to the screen projected behind her to help us stay on the most relevant piece of information. The way she did it really made us stay with her. Like, we couldn’t break eye contact.”

Once the in-person meeting did take place, Wong surprised the Emergence team. For one, she stood up to pitch. Wong explained that her co-founder is a bigger guy, and she’s a smaller woman, and she feels more confident and comfortable presenting from a standing position.

“She was one of the few or maybe the only CEO who ever stood up to pitch the entire team,” said Siniscalco. “She pointed to the screen projected behind her to help us stay on the most relevant piece of information. The way she did it really made us stay with her. Like, we couldn’t break eye contact.”

In terms of delivery, Wong had already made an impact. But the content of the deck, and her experience in retail, clinched the deal.

“I look for an unfair reason for a founder to be the perfect person to build this product,” said Siniscalco. “Wong gave us her background in the first slide, and I knew quickly that she was a credible person in the retail industry. Then, what I look for in a pitch, is customer love.”

Siniscalco said the combination of that unfair advantage and intense customer love is highly correlated with a very positive outcome for a company.

“When we first started out, I was really insecure because I came from the industry versus coming from a lot of Silicon Valley knowledge,” said Wong. “In retrospect, I really underestimated the competitive advantage of coming from the industry. People said it to me, but I didn’t understand what that resulted in. But it resulted in the numbers in our deck, because I know what customers want, what they want to buy next, how to keep them happy and I was able to be way more capital-efficient.”

The Zipline deck

Zipline’s entire deck (with some minor redactions) is embedded below. You can swipe on through at your leisure, but the real value here (in my humble opinion) is Siniscalco’s breakdown of how she reacted to the information in the deck. I’ll relay that here in text, but I also strongly suggest you watch (at least) the first half of the episode below to hear the founder/investor duo walk us through this deck.

The first bit that stood out to Siniscalco was the logo slide, showing the clients Zipline had brought on. Though Wong worked at Gap and Old Navy (which were clients), there were a variety of logos pictured that had nothing to do with Wong’s background.

“If it was only Gap and Old Navy, which she obviously had experience with, it would be different,” said Siniscalco. “But this is such a broad and reputable group that it made me believe that the product that she was building was on the right track towards finding product-market fit.”

But Wong took that list of clients and made it even more powerful to her potential investors.

During due diligence, Wong challenged Emergence to go into any of the retail stores that the startup worked with and ask the store team what they thought of the product. It’s easy to pair a potential investor with the procurement lead for the software — that individual obviously believes in the value of the product or they wouldn’t have purchased it. Wong was bold and said “ask anyone.”

“Those are the kinds of games of chance you have to play as a founder sometimes,” Wong said. “Is this 17-year-old in this Bevmo going to speak highly about me? But that’s the advantage we have.”

Customer love, which Siniscalco prioritizes as an investor, came through on the sixth slide. Zipline showed customer love in myriad ways, including customer churn percentage and conversion rate from pilot to closing of contract. In the case of Zipline, the company went into Series A fundraising with 0% customer churn and 100% conversion from pilot to contract.

Image Credits: Retail Zipline

At the time, Siniscalco was impressed but didn’t expect that latter metric to remain at 100%. Lo and behold, it has.

Net promoter score, meanwhile, “is a very simple metric that I encourage all entrepreneurs to track as soon as possible,” said Siniscalco. “If you can show either high NPS or a strong improvement in NPS, that is another very good indicator that you’re hitting strong customer love.”

The last bit of customer love evidence that Siniscalco was attracted to was that 60% of customers were purchasing additional modules. Investors love seeing strong product-market fit, but they also want their imaginations tickled. Being able to paint a picture of growth is critical.

“The fact that 60% of customers were buying additional modules also told me that she not only has really strong prime market fit with core, which is the main product, but because she knows the customer so well, she has already developed additional products and knows how to sell them.”

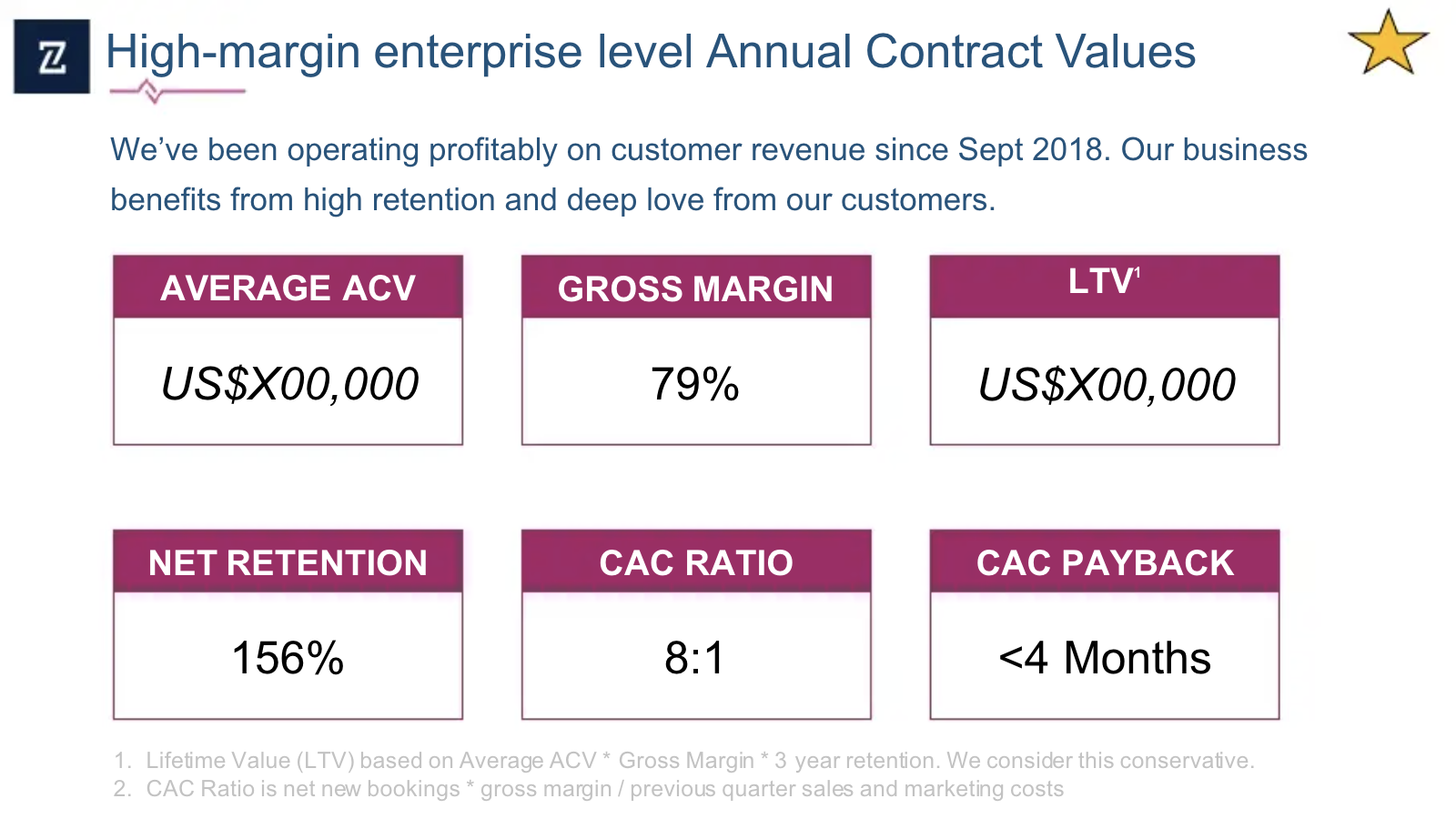

Last, but not least, Siniscalco outlined the metrics she looks for most with enterprise startups. Turns out, Wong included them in the exact format that Siniscalco prefers:

Image Credits: Retail Zipline

“I personally tend to anchor into CAC payback more than, for example, LTV,” said Siniscalco. “CAC payback really tells you how long you have to wait before you’re able to recover the cost to acquire a customer, and as an investor, I know that if this is too long, I have to fund it.”

Retail Zipline Series A Deck by Jordan Crook on Scribd