Founders, entrepreneurs, and tech executives in the know realize they may be able to avoid paying tax on all or part of the gain from the sale of stock in their companies — assuming they qualify.

If you’re a founder who’s interested in exploring this opportunity, put careful consideration put into the formation, operation and selling of your company.

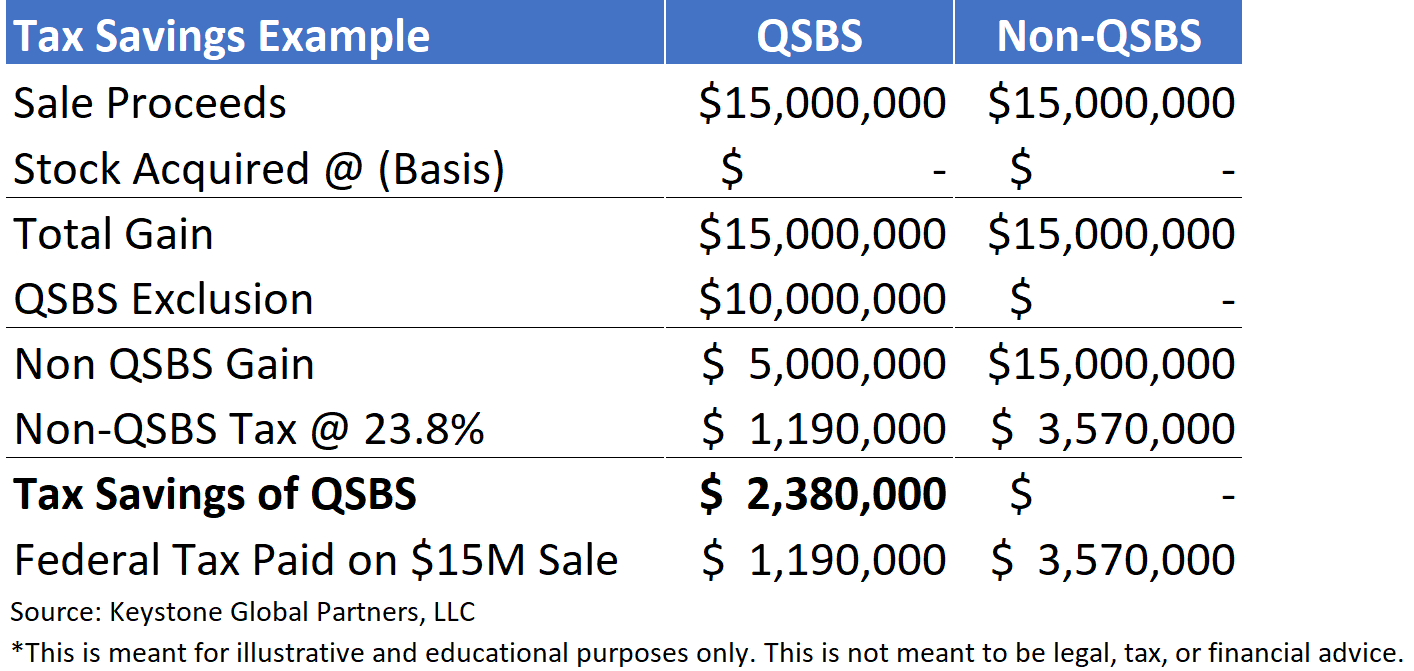

Qualified Small Business Stock (QSBS) presents a significant tax savings opportunity for people who create and invest in small businesses. It allows you to potentially exclude up to $10 million, or 10 times your tax basis, whichever is greater, from taxation. For example, if you invested $2 million in QSBS in 2012, and sell that stock after five years for $20 million (10x basis) you could pay zero federal capital gains tax on that gain.

What is QSBS, and why is it important?

These tax savings can be so significant, that it’s one of a handful of high-priority items we’ll first discuss, when working with a founder or tech executive client. Surprisingly, most people in general either:

- Know a few basics about QSBS;

- Know they may have it, but don’t explore ways to leverage or protect it;

- Don’t know about it at all.

Founders who are scaling their companies usually have a lot on their minds, and tax savings and personal finance usually falls to the bottom of the list. For example, I recently met with someone who will walk away from their upcoming liquidity event with between $30-40 million. He qualifies for QSBS, but until our conversation, he hadn’t even considered leveraging it.

Instead of paying long-term capital gains taxes, how does 0% sound? That’s right — you may be able to exclude up to 100% of your federal capital gains taxes from selling the stake in your company. If your company is a venture-backed tech startup (or was at one point), there’s a good chance you could qualify.

In this guide I speak specifically to QSBS on a federal tax level, however it’s important to note that many states such as New York follow the federal treatment of QSBS, while states such as California and Pennsylvania completely disallow the exclusion. There is a third group of states, including Massachusetts and New Jersey, that have their own modifications to the exclusion. Like everything else I speak about here, this should be reviewed with your legal and tax advisors.

My team and I recently spoke with a founder whose company was being acquired. She wanted to do some financial planning to understand how her personal balance sheet would look post-acquisition, which is a savvy move.

We worked with her corporate counsel and accountant to obtain a QSBS representation from the company and modeled out the founder’s effective tax rate. She owned equity in the form of company shares, which met the criteria for qualifying as Section 1202 stock (QSBS). When she acquired the shares in 2012, her cost basis was basically zero.

A few months after satisfying the five-year holding period, a public company acquired her business. Her company shares, first acquired for basically zero, were now worth $15 million. When she was able to sell her shares, the first $10 million of her capital gains were completely excluded from federal taxation — the remainder of her gain was taxed at long-term capital gains.

This founder saved millions of dollars in capital gains taxes after her liquidity event, and she’s not the exception! Most founders who run a venture-backed C Corporation tech company can qualify for QSBS if they acquire their stock early on. There are some exceptions.

Do I have QSBS?

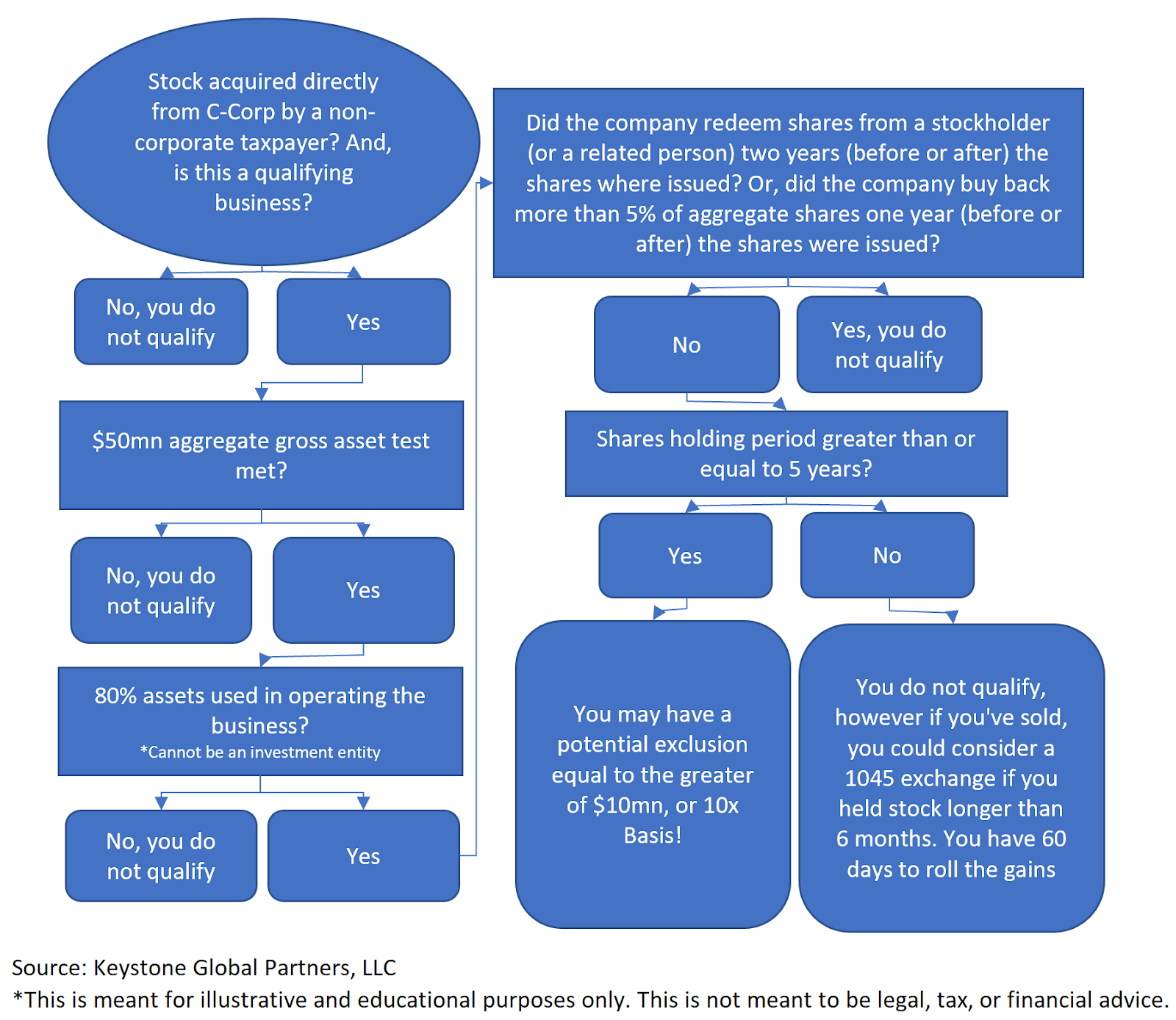

A frequently asked question as we start to discuss QSBS with our clients is: how do I know if I qualify? In general, you need to meet the following requirements:

- Your company is a Domestic C Corporation.

- Stock is acquired directly from the company.

- Stock has been held for over 5 years.

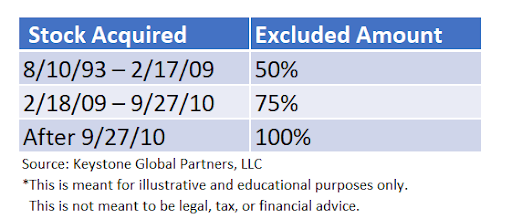

- Stock was issued after August 10th, 1993, and ideally, after September 27th, 2010 for a full 100% exclusion.

- Aggregate gross assets of the company must have been $50 million or less when the stock was acquired.

- The business must be active, with 80% of its assets being used to run the business. It cannot be an investment entity.

- The business cannot be an excluded business type such as, but not limited to: finance, professional services, mining/natural resources, hotel/restaurants, farming or any other business where the business reputation is a skill of one or more of the employees.

When in doubt, follow this flowchart to see if you qualify:

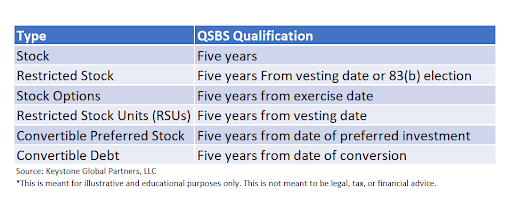

When does the 5-year clock start ticking for QSBS?

One of the most important requirements for getting the QSBS exclusion is that you’ve held your stock for 5 or more years; the clock doesn’t start until you actually acquire the shares. We’ve run into examples where people think they’ve met the requirements, but unfortunately, they did not. Take a look at a few examples here:

Let’s look at original issuance in this real-life example. One of our clients was curious whether he had QSBS. He had invested early in his friend’s company, which had achieved unicorn status, making his investment a home run.

However, his investment was made via a SAFE note, which is not abnormal at that early stage in the company’s life. But when that SAFE note converted, the aggregate gross assets of the company were well in excess of the $50 million cut off. Although his holding period is greater than 5 years and everything else ticked the boxes, the $50 million aggregate gross assets test was not met and he did not qualify.

Actionable tip: If you are using a SAFE or Convertible Note, it’s important to know that the asset requirement and holding period does not start until you receive the actual shares from the C Corporation.

What happens if I sell my stock or it’s acquired before 5 years?

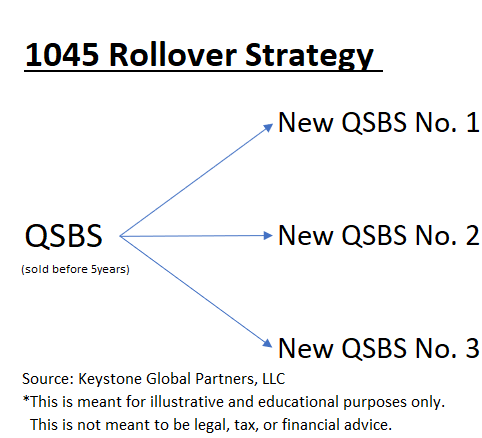

You may be able to leverage Section 1045 of the Internal Revenue Code. Section 1045 allows for QSBS holders to roll over gains received from the sale of qualifying QSBS, into QSBS of a different issuer(s). In this situation, you want to be mindful of two key timelines:

- The original QSBS must be held for more than six months at the time of the disposition

- The rollover must occur within 60 days

Actionable tip: It’s also important to note that a 1045 election needs to be filed on or before the tax return date for the tax year of the 1045 rollover.

Keep in mind that although 1045 rollovers are permitted in these situations, you don’t want to make a rushed investment decision just to meet the 60-day rollover deadline. In fact, I find more times than not, that the stars do not align here. It’s not realistic to roll all the gains from your exit, back into favorable early-stage venture investments, that you can source within 60 days!

However, if the stars do align and you have a favorable opportunity, you can take advantage of it in a tax advantaged way. For example, if you qualify to leverage a Section 1045 rollover, you could hypothetically roll the gain of your disposition QSBS into three new QSBS eligible companies – and potentially receive QSBS treatment from all three new companies later on. That’s a win!

Real-life QSBS situations you may encounter

You own QSBS that was acquired by a company whose stock is not QSBS

Even if your QSBS stock is acquired in a stock transaction by a company whose stock isn’t QSBS, the stock you receive would maintain its QSBS treatment, but only up to the price of the exchange. Example, your company is bought and now you own shares equal to $10 per share in the acquiring company. Assuming your five-year holding period is met, you only get to claim the exclusion up to the gain on the date of the acquisition, the $10 per share. If you hold the shares and they increase to $20 per share and then you sell, you still only get to claim $10 per share for QSBS purposes. The additional gain would be counted as regular capital gains.

Example:

A private company was acquired by a public company. An early employee had received restricted shares in the private company early on and filed her 83(b) upon receipt of the private company’s shares to start her holding period.

The private company was acquired, 4 years after she filed her 83(b), by a public company and she received new stock in the public company. She waited one more year (total 5 year holding period), then sold the new public company stock. During the last year, that public company stock had increased in value.

Her shares met QSBS requirements. She can claim the QSBS exclusion up to the gain on the date of acquisition. She pays capital gains tax on any stock appreciation over the price at which she received the public company stock.

Actionable tip: An 83(b) election allows you to pay taxes on restricted shares, based on fair market value of the shares at the time of granting rather than at the time of vesting. You have 30 days after being issued the shares to do this. This is particularly appealing during the early stages of a company’s life, when the tax due may be very little due to a lower company valuation.

You invest in venture capital and/or private equity

For those who are investing in private equity or venture capital, or those who are making co-investments, QSBS may also be in play. Typically, some of these investments will be made through LLCs taxed as partnerships.

Assuming the LLC taxed as a partnership is the original QSBS purchaser, the QSBS eligible gains may be able to be passed through to the underlying investors as long as the 5-year holding period has been satisfied. For venture capital firms, things can get more complicated at the general partner level, and you’ll need to speak with your legal and tax advisors.

And also remember that if the investment is done through a convertible note, the 5-year QSBS clock does not start ticking until that note is converted to equity.

This can get complicated with record-keeping but generally, we’d recommend asking for a QSBS representation from the company, to the extent possible, and making sure it is included in the stock purchase agreements.

How to not blow your shot at QSBS

You may be asking yourself: there are so many requirements, what do I need to watch out for so I don’t blow it? The truth is, there are multiple ways, but here are a few of the more common ones to look out for:

#1: S-Corporation trap

Only investments into a C Corporation will qualify as QSBS. If you start your company as an S Corporation, then later change the status to a C Corporation, the QSBS eligibility would be lost. However, there could be a workaround involving the starting of a newly formed C Corporation. Proper tax and legal guidance is very important here.

#2: Active business requirement

The “active business requirement” states that you need to ensure that 80% of the company’s assets are being used in the active conduct or business. Generally, most early stage C Corporation startups will qualify for this as long as they are not an excluded business or trade such as service businesses, hotels, investing, finance/insurance/banking, leasing, farming, mining, or oil and gas.

#3: Redemptions from the company

One of the biggest traps that founders face when it comes to QSBS is that they don’t pay close enough attention to the company’s redemptions of stock. My team and I have seen this several times unfortunately. Recently, we came across a situation while helping a group of early employees with some pre-sale planning.

Unfortunately, early in the company’s life, shares had been redeemed by the company from the brother of one of the founders. This redeemed stock, even though it was a small amount in the grand scheme of things, disqualified the QSBS for the rest of the company.

Yikes! This is a situation you definitely want to avoid. When it comes to redemptions, two types of redemptions can blow your QSBS:

- Redemptions of over 5% of the stock by your company, within one-year (before or after) stock is issued by your company

- Redemptions of stock by the company, from recipient or related person within two years (before or after) stock is issued by your company

#4: Don’t gift QSBS stock to charity

For those who are charitably inclined, gifting long-term appreciated low basis stock to charity can be a win-win situation. However, it’s better to gift long-term appreciated non-QSBS stock with low basis. Gifting QSBS stock is taxably inefficient. Certain situations could make sense where there is a 50% or 75% exclusion percentage, when the holding period is less than five years, or if you’ve already taken your $10 million exclusion. This should be reviewed with a professional.

#5: Don’t contribute QSBS to a Family Limited Partnership (FLP)

Many affluent entrepreneurs and families will use Family Limited Partnerships (FLPs) for wealth transfer and to organize and consolidate the family’s investment activities. While the gifting of QSBS can be very beneficial, and making an investment directly from the FLP into the C Corporation is acceptable, it should be known that contributing QSBS directly to a partnership will disqualify the stock’s QSBS status, and should be avoided.

#6: Team familiar with QSBS

Many financial advisers, accountants and attorneys are only vaguely familiar with QSBS. It’s important to have the right team in place looking out for you. However, it is your responsibility to be aware, and document the requirements. I encourage all of my clients to post me if they are going to make any financial decision related to their company or QSBS stock so we can confirm with certainty that it will not have any adverse effects. Sometime this is an easy, yes or no, other times it will require a more thorough analysis and involve lawyers and accountants.

My team and I found an opportunity to get a client a tax refund of about $250,000. His company was acquired by a public company years ago. He received stock in the deal and sold the stock at a later date. The total stock holding period was 5 years (original stock holding period + public stock holding period) and his accountant had completely missed the opportunity, even after having been informed. The point here is that it’s easy for this to slip through the cracks if someone is not familiar with it. Needless to say, he found a new accountant shortly thereafter.

#7: Documentation

Protect yourself by documenting everything. There are many requirements so it is incredibly important to maintain good records. We always say document QSBS status early and often, and after every round of financing. Ask your company to help you with documentation if necessary. You can (and should) be documenting:

- Date of purchase

- Consideration paid

- Representation that your company is below $50 million in aggregate gross assets

- Certification that your company has 80%+ its’ assets being actively used in operating the business, and intends to continue to do so

Final thoughts

There are many resources available online to walk you through the intricacies of QSBS. However, beyond digging through tax code line by line, your best bet is to start by speaking with a professional. This is not something you want to DIY, and the appropriate advice is worth its weight in gold. Remember – QSBS may seem like a hassle, but it’s powerful. And if you qualify, it could be legitimately life-changing.