Currencycloud, the provider of an API and service for cross-border payments that is used by a host of fintechs and larger companies, including most recently Visa, has closed the first part in a round of Series E funding.

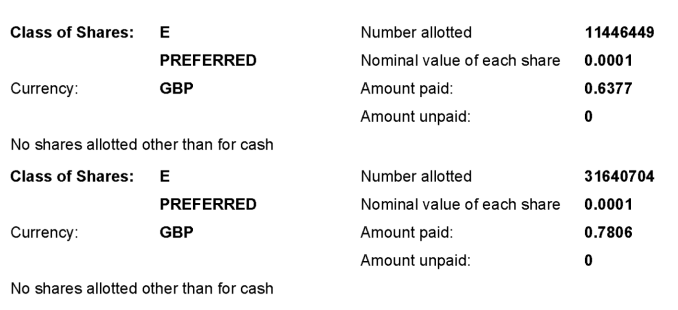

According to sources, the over 10 year old London headquartered company announced internally that it was closing in on new funding a few weeks ago, while a recent regulatory filing reveals that the Series E totals just shy of £32 million in new shares issued so far. However, I understand that this is just tranche one, and that additional Series E funding will follow within the next 2-3 months when the round will be officially announced. Tranche one also consists of two slightly different share prices as it sees earlier debt financing converted into equity.

With regards to who is backing Currencycloud’s Series E, one source tells me Goldman Sachs is in the running and is possibly leading the round. Existing investor GV (previously Google Ventures) is said to be following on. I’m also hearing that another new investor could be Spanish bank Santander, via its venture arm Santander InnoVentures, in what would signal a significant strategic investment and/or partnership. Currencycloud declined to comment.

With regards to who is backing Currencycloud’s Series E, one source tells me Goldman Sachs is in the running and is possibly leading the round. Existing investor GV (previously Google Ventures) is said to be following on. I’m also hearing that another new investor could be Spanish bank Santander, via its venture arm Santander InnoVentures, in what would signal a significant strategic investment and/or partnership. Currencycloud declined to comment.

Launched more broadly in 2012 after raising a Series A in 2011 — and long considered a mainstay of the London fintech ecosystem (the company was even used heavily by TransferWise in its early days) — Currencycloud has built out payments infrastructure for cross-border payments and money transfer. Specifically, the company offers an API for businesses that need to offer their customers international money transfers.

Now operating across Europe, along with the U.S. and Canada, the company has to date processed more than $50bn in transfers, sending money to over 180 countries. The banks and fintechs that Currencycloud works with globally include Starling Bank, Standard Bank South Africa, Visa, Travelex and Klarna. The company’s team now sits at over 200 employees (see photo above) across multiple international offices, including London, Amsterdam and New York.