Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Yesterday news broke that Robinhood is on the hunt for new capital at a roughly flat valuation, per friend of the blog Katie Roof. If you are a bit confused by the news, I understand. Robinhood went through a gauntlet of bad press and user complaints after it suffered from some embarrassing downtime back in March, and isn’t the capital market for private companies in rough shape?

But the round is more reasonable than you’d think, namely because Robinhood’s revenue has reached real scale, and, like other savings and investing-focused financial applications, it’s enjoying a boom in demand. Showing that there’s buzz in helping people save, let’s talk about Robinhood briefly and dig into some other metrics from its loose cohort of companies (including M1 Finance, more about them in a moment) .

Growth

In late March, TechCrunch’s Jon Shieber noted that “financial markets may be sliding globally, but interest in stock trading apps soars.” In the piece, he recognized that not only were “speculative stock trading apps offered by startups like Robinhood” seeing what appeared to be lots of downloads when viewed through the lens of third-party trackers, but “savings-focused investment applications like Acorns” were also performing well.

It seemed that as the markets crashed, people were hunting either for stock market bargains or a place to squirrel away their capital and perhaps get into a better savings habit. TechCrunch touched on this trend last week when we noted in a fintech round-up that savings and investing services were boasting about usage gains.

Let’s add to that list.

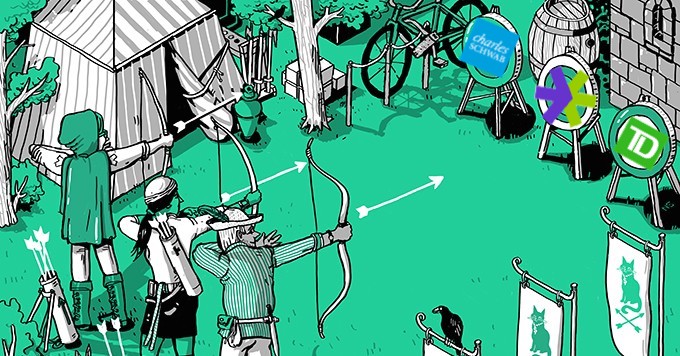

M1 Finance, a Chicago-based investing and savings service, shared some data this week about its usage gains during these turbulent weeks (recall that TechCrunch covered M1 Finance reaching $1 billion AUM earlier this year). The startup, in a bit of a Twitter dunk, noted that it saw 119,000 new brokerage accounts in Q1 versus 609,000 at Charles Schwab. The implication of the comparison being that M1, a much smaller shop, was pulling in a material fraction of its far-larger competitor’s new accounts; M1 noted in the same tweet that it has around 0.02% of Schwab’s AUM, making the new accounts comparison all the more striking.

Non-traditional fintech savings and investing apps are doing real numbers. Robinhood is as well. The company shared with TechCrunch that its customers executed about three times as many trades per day (an averaged metric) in March than it did in the fourth quarter of 2019. And, more notably, in March it saw “more than 10x net deposits” when compared to its Q4 2019 monthly average.

Back to Bloomberg, Robinhood generated revenue of $60 million in March, treble its year-ago result. It is not clear if Robinhood will continue to record revenue of that scale in April or later months if the markets quiet; but a $60 million quarter shows that Robinhood is growing into its valuation despite pushing it higher, and higher during its historical fundraising.

That brings us back to the possible new capital for Robinhood. In its last known funding round, Robinhood raised $323 million at a roughly $7.6 billion post-money valuation. Raising $250 million more at a valuation of around $8 billion implies that the firm would be valued at around the same post-money valuation. Flat is the new up, as Stripe showed us yesterday, so instead of reading this as a round to be tutted at, I can’t help but view it as bullish — provided it closes.

Robinhood keeps surprising, to its credit. If it can close another quarter billion in capital and sustain its revenue gains, perhaps we’ll move the firm onto our more serious lists of IPO hopefuls.

Of course, it’s catching a tailwind in consumer activity right now, but how is that a sin?