New-market disruption is a rare phenomenon and usually comes in waves in conjunction with some form of dramatic technological advance. Many disruptive companies (both new and existing) created new markets in periods following the introduction of PCs (Apple, Microsoft), mobile phones (Apple, Samsung) and cloud computing (Facebook, Airbnb).

And this is exactly what we are seeing in the enterprise market today. Large companies have been slow to embrace mobility and cloud computing. But that is changing.

A study of 1,600 large enterprises published by IDG showed that 69 percent of enterprises have either applications or infrastructure running in the cloud, up from 12 percent in 2012. That’s more than 5X growth in just two years. A 2015 survey of companies with more than 1,000 employees published by RightScale shows that number at 92 percent.

This is an opportunity the likes of which we haven’t seen since the PC revolution of the late 1980s and early 1990s. And many startups are taking advantage of this opportunity right now. Only a couple of years ago, it would have been pretty hard for a startup like Influitive, for example, to sell its category-making advocate marketing platform to the likes of Intuit, HP and BMC. And it would have been nearly impossible for an enterprise e-learning startup like OpenSesame to close deals with 30 of the global Fortune 2000 in one year, including SAP, Siemens and Dish.

So how do you take advantage of this?

Opportunities exist in every major category. Think of new markets and all the things that SMBs have been doing and large business have not. Think new generation of social marketing and marketing automation, mobile-first business apps, IP telephony, payments, etc.

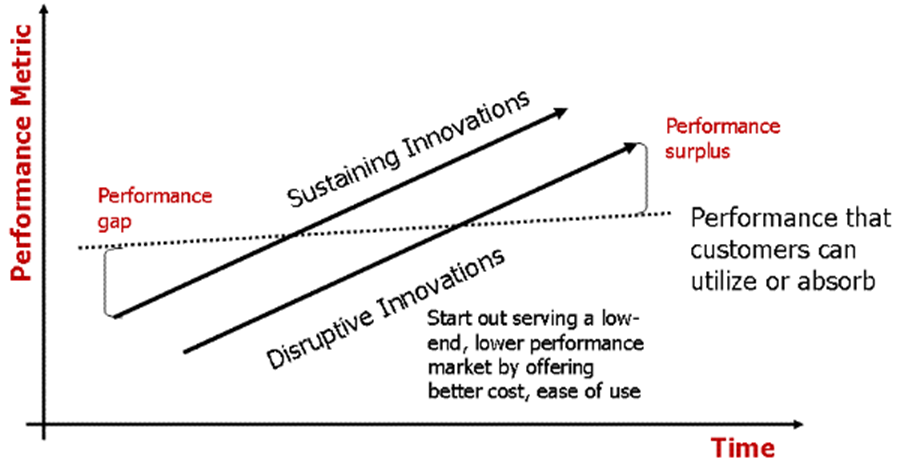

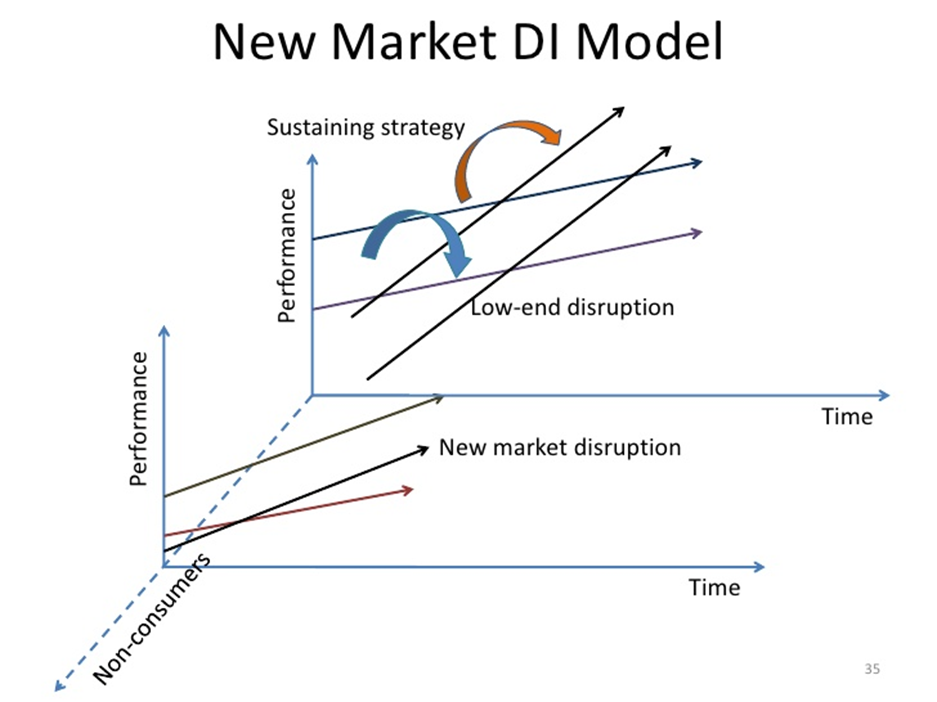

But also think about categories that are of interest specifically to larger companies, like cloud security, identity and access management, compliance, document and contract management, enterprise service bus (ESB) and other middle-layer technologies. Even if your startup is going after the low-end disruption methodology, you don’t have to position it as a product with a smaller feature set at a lower price.

Position it as a product with a different feature set (and perhaps a different value proposition, too). Yes, you do not have all the bells and whistles of some huge clunky ERP system, but you offer benefits that they can’t (support for mobile devices, distributed teams, millennial-friendly user experience, etc.).

Five things to think about when entering the enterprise market

Finally, let’s talk about what you need to think about when building an enterprise cloud service from scratch, or re-tooling an SMB product to go upmarket (which is much harder than it sounds). The first is obviously the functionality, but we are going to mention a few less-obvious things. This is not even close to being a complete list, this is just food for thought.

Security

Large companies are notorious for being security-conscious. Most public cloud services like AWS and Azure actually meet a lot of those requirements, like SOC2, but they might ask for additional things like audit rights, password rotation, etc.

Legal/Procurement

This is perhaps the single-most challenging part of doing business with large companies. Have a contract attorney at your disposal. They will not sign your paper. Be prepared to negotiate theirs. They might ask for indemnification, IP in escrow, insurance and a number of other things. Have an answer for them (and it shouldn’t always be “we’ll do whatever you want”).

Sales team

In SMB, we often talk about frictionless transactions and self-service. This will not work in enterprise. You need a solid sales team; although, nowadays, this can be a team of inside sales reps who do not need to get on a plane for every deal.

Unit economics

Enterprise business has completely different economics than SMB. Large companies sign multi-year contracts and pay for a full year up front. Your annual account churn should be in low single digits and your net dollar churn should actually be negative. Enterprises are not less price sensitive, so do not under price your service. Each department wants to spend 100 percent of their budget or they lose it next year. The business is highly seasonal. You might do four times more business in Q4 than Q1.

Metrics

Because of a different business dynamic, you need a different set of metrics and measurements. Simple back-of-the-napkin CAC and LTV calculations don’t work. With low single-digit account churn and negative dollar churn, LTV calculations must become more sophisticated. You need to adjust for marketing cycle, sales cycle, seasonality, account growth and net present value.

In this environment, a startup going after Fortune 500 accounts can grow explosively. If you need a benchmark, top startups in the space grow 300 percent YoY. I believe that the next billion-dollar enterprise product will not come from today’s giants, but from a startup that’s only a couple of years old right now — and may be even one that hasn’t been founded yet.