A few days ago, at the DLD conference, Groupon CEO Andrew Mason revealed that his three-year-old daily deal company now has 10,000 employees, with about 70 percent overseas. What about LivingSocial, the No. 2 daily deal company? Tim O’Shaughnessy told me yesterday the company is now at 5,000 employees worldwide, with “just under half” in the U.S.

While he won’t reveal LivingSocial’s revenues (the company is still private, and just raised another $176 million in December), he says: “We’ve grown very significantly in the last 12 months. We entered 2011 with 3 countries,, now we are at more than 20, with 60 million members worldwide, and just around 5,000 employees worldwide. We have been able to aggressively grow the business.”

But what about all of the Groupon and LivingSocial clones dropping like flies? Is the daily deal business winners-take-all, with Groupon and LivingSocial emerging victorious, or is the whole industry in trouble? One recent study, estimates that 798 daily deal clones hit the deadpool in the last 6 months alone. “A lot of people started to scale and started to realize they didn’t have all the pieces needed to make it work,” says O’Shaughnessy.

The bigger question is whether the whole industry’s moment in the sun has passed. After all, the daily deal business was born in the worst recession since the Great Depression when deals were especially appealing. Now there is deal fatigue, and the economy isn’t in as dire straights. O’Shaughnessy doesn’t see it that way. “The business is not predicated on being in a recessionary cycle,” he argues, pointing to its success in countries like Brazil whose economies are doing well.

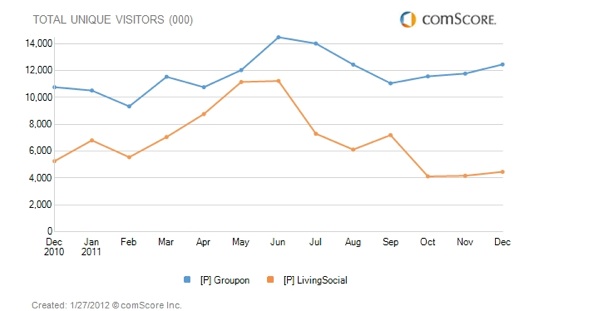

Okay, but what about the fact that traffic to LivingSocial has dropped significantly since last summer? In the daily deals business, historically, at least, there was a strong correlation between traffic and transactions. According to comScore, visitors to LivingSocial’s site peaked last June at 11.2 million worldwide. In December it was down to 4.4 million. Groupon also took a hit, peaking at 14.4 million worldwide unique visitors in June, but it’s been growing steadily since September and was back up to 12.5 million uniques in December. (See chart above).

There is another factor to consider here, however. “Everybody knows,” says O’Shaughnessy, “a lot of marketing has gone into this space. Guess what? When you click on an ad and you are taken to a page, that is traffic. Once you get enough users, if you stop doing some of that marketing, you will have a significant drop in traffic.” The daily deal companies were paying through the nose for traffic. It certainly showed up in Groupon’s numbers. And LivingSocial was doing the same thing. We’ll find out when Groupon announces its first earnings quarter, how much it is continuing to spend on marketing, but LivingSocial has pared back and is now focussed on harvesting the 60 million users it already has a relationship with. Also, these numbers don’t measure mobile, which is “an incredibly meaningful percentage of interaction,” notes O’Shaughnessy.

The one thing I took away from my conversation with him is that you can’t be too simplistic in your analysis of these businesses. Not every customer is the same either. the 60 millionth customer does not behave the same way as the 1 millionth, and mobile app users are much more engaged. It is important to look at cohorts of customers (people who joined a year ago versus 6 months ago), and see if older customers are becoming more loyal.

Most importantly, he sees the daily deal business as we know it today merely as an entry point for local commerce. It is version 1.0, and he is already building version 2.0, which could make LivingSocial end up looking significantly different from Groupon down the road. I will delve deeper into where LivingSocial might be headed in another post.