The economy is a mess. And while venture capital is still flowing like whiskey during the Prohibition, it’s not right for every business. A year ago we wrote about the birth of a new type of investment fund, Revenue Loan. The experiment has worked, says founder Andy Sack.

They’re expanding it, changing their name, and offering $500,000 to the right type of startup.

First, the basics. Revenue Loan is now Lighter Capital. They’ve completed eight revenue loans in the last year. The companies received $100k – $500k each in a loan. They then pay a small (3ish) percent of their monthly revenue to Lighter Capital until the initial capital has been paid off 3x-5x. Sound expensive? It can be a lot cheaper than equity venture rounds in the long run for the right companies.

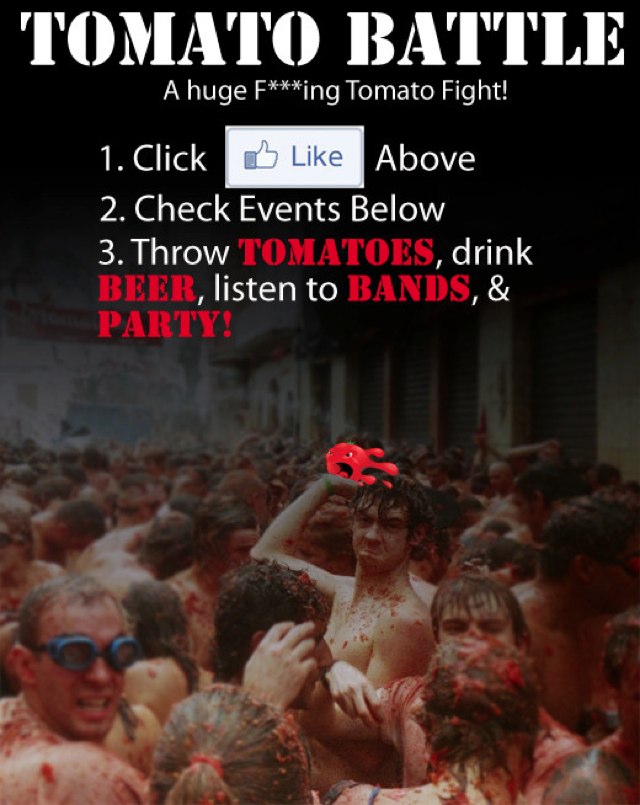

Usually Lighter is looking for startups with real revenue and growth. But in at least one case they invested pre-launch. Check out Tomato Battle, where thousands of people are paying $50 to have a massive tomato fight. You’ll probably see me at the next one throwing tomatoes along with everyone else.

Tomato Battle was a new type of deal for Lighter Capital. They were pre-revenue, so it wouldn’t normally qualify. But The Lighter team got comfortable based on the team behind the events as well as the early buzz on Facebook. So, they made the jump.

Lighter says they’re going to invest up to $500k in a new company this month. If you think you can win, details are here.