Banking startup Simple has been acquired, the company announced today. The acquiring company, BBVA, is a 150-year old financial services corporation that operates in a number of markets, and a leading player in the Spanish market, as well as one of the top 15 banks in the U.S. and a strategic investor in banks in Turkey and China.

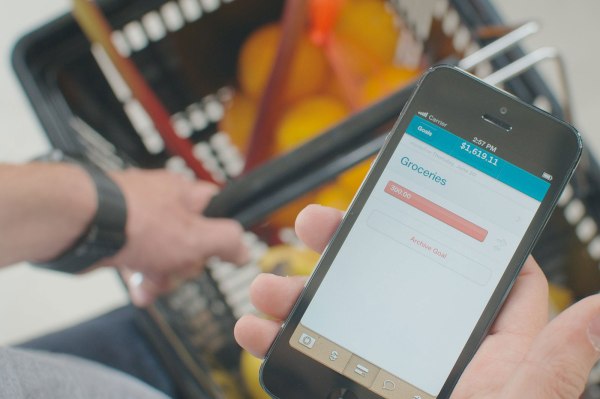

Simple will continue to operate as it has done to date, and promises that nothing will change for customers who are already on the platform. The Portland-based company was founded on the idea that banks don’t provide adequate online and mobile tools to properly service their customers. While not itself a bank, Simple operates as an intermediary between users and FDIC-insured institutions to provide users with access to data around their financial history, as well as tracking of expenditures and savings goals, with automated purchase data collected when its customers use their Simple Visa debit card.

Originally founded in 2009, Simple co-founders Shamir Karkal and Josh Reich wanted to put people in control of their own finances. With established banks, data about customers’ own financial status was either kept squirreled away out of sight, or discarded altogether. This driving vision has helped the company accrue over 100,000 customers, with 330 percent growth recorded in 2013, and total transaction value of over $1.7 billion.

The acquisition is designed to help Simple continue to scale while offering the same service, according to a blog post by Reich:

To achieve this, we will function as a separate business within the BBVA structure, operating in parallel with BBVA’s existing US banking operations. Furthermore, I’m remaining in my role as CEO and will be joined by the same team that built Simple over the past four years. The biggest change is that now we will have the support of a global banking group with $820 billion in assets that shares our passion for innovative technology and customer experience.

Customer accounts will remain at Bancorp for now, which is Simple’s current FDIC-insured partner, but the implication is that eventually customer accounts will be migrated over to BBVA so that Simple can have total control over the entire banking experience, another perk of the acquisition.

Total funding for Simple is around $15.3 million, including investment from SV Angel, First Round Capital, Lerer Ventures, 500 Startups, Shasta Ventures, IA Ventures and more. It may not be WhatsApp numbers, but that still adds up to a tidy little return on investment for Simple’s financing partners.