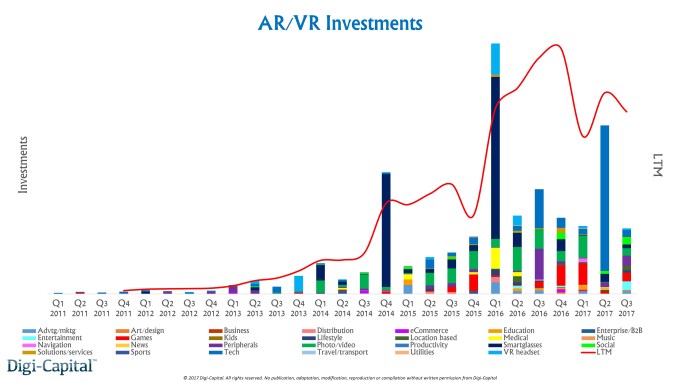

Mobile AR from Apple (ARKit), Google (ARCore) and Facebook (Camera Effects) and computer vision/machine learning (CV/ML) are focusing the minds and wallets of VCs in Silicon Valley, China and beyond. The $2.5 billion invested in AR/VR so far this year ($1 billion in October and November alone) was balanced across AR and VR, but now mobile AR and CV/ML are the new hotness (as VR has cooled).

Digi-Capital advises a broad range of VCs and startup CEOs, so I spoke to a few friends about how the investment market has evolved. You can read what nearly 30 prominent VCs had to say below, but for the TL;DR crowd:

- Mobile AR and CV/ML are at opposite ends of the spectrum — one delivering new UX/UI and the other powering a broad range of new applications (not just mobile AR).

- Mobile AR is very early stage, and could see $50 to $100 million exits in the next 18-24 months. Dominant companies will take time to emerge.

- CV/ML is more advanced, and could see dominant companies in the medium-term.

- It will take time for developers to learn what works and consumers/enterprises to adopt mobile AR at scale (note: Digi-Capital’s base case is mobile AR revenue won’t really take off until 2019, despite 900 million installed base by Q4 2018).

- VCs are looking for startups to dominate a vertical first, then turn that into a horizontal platform play (note to startup CEOs: VCs will laugh at your “we are a mobile AR platform” deck today).

- VCs are interested in native mobile AR, not ports from other platforms.

- VCs love CV/ML startups with real-world solutions to fundamentally disrupt industries, not research projects.

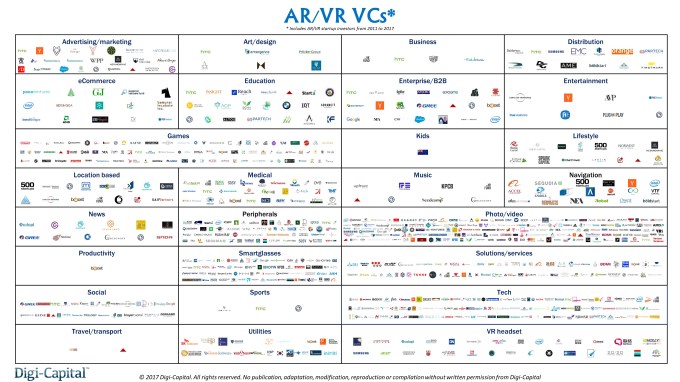

- VCs are investing in more than 20 different mobile AR and CV/ML sectors, but they’re not the same VCs (obvious note to startup CEOs: don’t spam; understand VCs as individuals and think about how you fit their portfolio — generalist VCs might make only one or two bets in this space).

- VCs themselves could pose a risk, with the potential for overfunding during the earliest stages of mobile AR.

That’s enough from me. Let’s hear from them.

Aydin Senkut, Felicis Ventures

Felicis Ventures Founder/Managing Director Aydin Senkut invests in both reinvention of existing industries and frontier tech opening new markets, and sees opportunities in mobile AR and CV/ML quite differently. “Mobile AR for us is a consumer opportunity, but one where there needs to be breakout hits to popularize the potential of ARKit and ARCore. That dynamic makes it harder to succeed, but the successes will be big when they get here. One of the challenges is avoiding what the major platforms will build themselves.”

“CV/ML has fewer pure platform plays, but many broad use cases as an enhancing technology across industries — it is genuinely disruptive.” Senkut’s approach with Felicis is all about “engineering serendipity” with “diverse, calculated, risk-adjusted bets in markets where there is a lower level of VC competition. We’re not so presumptuous to think that we know what the future looks like, but we’re confident that when it walks through the door we sometimes recognize it.”

Jenny Lee, GGV Capital

GGV Capital China Partner Jenny Lee thinks in terms of horizontal platforms (e.g. search, messaging, e-commerce), and the verticals that leverage them (e.g. travel, HR, games). In that context, the firm is interested in how data across platforms and verticals is processed by AI/ML systems for both consumers and enterprises. “We think of AR as one way to represent what comes from CV and other AI/ML technologies, so an enabling technology to create something useful.”

China Partner Jenny Lee thinks in terms of horizontal platforms (e.g. search, messaging, e-commerce), and the verticals that leverage them (e.g. travel, HR, games). In that context, the firm is interested in how data across platforms and verticals is processed by AI/ML systems for both consumers and enterprises. “We think of AR as one way to represent what comes from CV and other AI/ML technologies, so an enabling technology to create something useful.”

With automation a priority for China, the combination of CV and AR offers unique opportunities. “My favorite example is the humble mushroom. With huge variety in China (several poisonous), picking and sorting mushrooms is done by teams with 10 to 20 years’ experience. We’ve seen startups using CV and machine learning for categorization and labeling mushrooms, then using AR to enable less-skilled workers to do the sorting and selection. Eventually combined with robotics, a traditional part of industry becomes more scalable.”

Lee also sees opportunities in the Chinese education market. “Publishers have no relationship with students, as after they buy the book they don’t come back. The addition of AR features using mobile AR gives publishers an ongoing relationship and a means for further monetization.” In other words, turning a business with 100 percent churn into one with lifetime value.

Matt Murphy, Menlo Ventures

Menlo Ventures Partner Matt Murphy ran the iFund with Apple after the iPhone launched, which gives him a somewhat unique perspective. “The iPhone was a new computing device and represented a fundamental platform change, as it changed how we use phones forever. At the other end of the spectrum have been API-driven changes, such as location-based and health-focused APIs from Apple and others.”

Partner Matt Murphy ran the iFund with Apple after the iPhone launched, which gives him a somewhat unique perspective. “The iPhone was a new computing device and represented a fundamental platform change, as it changed how we use phones forever. At the other end of the spectrum have been API-driven changes, such as location-based and health-focused APIs from Apple and others.”

He sees the scale of ARKit and ARCore as somewhere between the two — not as big as a full platform change, but not as small as an API-driven incremental upgrade, either. “The opportunity for developers with ARKit and ARCore is to leverage a market that is already at scale. They don’t have the chicken and egg problem that most new platforms face, with a huge total addressable market at launch.”

Bill Malloy, Sway Ventures

Sway Ventures Founder/Partner Bill Malloy is passionate about both mobile AR and CV/ML opportunities. “Mobile AR is not VR, because it solves the distribution issue from day one with an installed base in the hundreds of millions. However the opportunities for investors in mobile AR and CV/ML are quite different. Mobile AR could see a bunch of $50 million to $100 million exits in the next couple of years, where CV/ML could drive a new generation of tech giants in the next 3 to 5 years.”

Founder/Partner Bill Malloy is passionate about both mobile AR and CV/ML opportunities. “Mobile AR is not VR, because it solves the distribution issue from day one with an installed base in the hundreds of millions. However the opportunities for investors in mobile AR and CV/ML are quite different. Mobile AR could see a bunch of $50 million to $100 million exits in the next couple of years, where CV/ML could drive a new generation of tech giants in the next 3 to 5 years.”

In machine vision/ML, he sees the value in “capturing, cleaning and owning the data at scale, and then broadening out from vertical products into dominant horizontal platforms.” However, “the talent pool in this space is either in universities or working for Apple, Google or Facebook. So for CV startups, the biggest challenge is people.”

Dr. Shahin Farshchi, Lux Capital

Lux Capital Partner Dr. Shahin Farshchi is looking to invest in “content and experiences which enable something totally new, and which aren’t possible with any other platform. The creative community will come up with breakout apps that users care about to drive mobile AR at scale.” So while he is investing in both underlying technology and enterprise applications, he believes that consumer apps need to popularize mobile AR first to build the market. “What nobody knows is when this will happen and what it will look like. It could be in the next three months, or it could be in the next 10 years.”

Partner Dr. Shahin Farshchi is looking to invest in “content and experiences which enable something totally new, and which aren’t possible with any other platform. The creative community will come up with breakout apps that users care about to drive mobile AR at scale.” So while he is investing in both underlying technology and enterprise applications, he believes that consumer apps need to popularize mobile AR first to build the market. “What nobody knows is when this will happen and what it will look like. It could be in the next three months, or it could be in the next 10 years.”

Jeff Clavier, Uncork Capital (formerly SoftTech VC)

Uncork Capital (formerly SoftTech VC) Founder/Managing Partner Jeff Clavier is an investor in hologram company Looking Glass and CV stealth startups. “I’m actively looking for mobile AR infrastructure opportunities, with a bias towards horizontal platforms over vertical products. The immediate scale of the new market is what makes it interesting, ranging from mass-consumer to industrial opportunities like remote assistance.” Clavier is broadly looking for two types of startups, “practical applications (e.g. Focal Systems) and visionary tech where use cases and business models will evolve (e.g. CV/neural network on a chip stealth startup).”

(formerly SoftTech VC) Founder/Managing Partner Jeff Clavier is an investor in hologram company Looking Glass and CV stealth startups. “I’m actively looking for mobile AR infrastructure opportunities, with a bias towards horizontal platforms over vertical products. The immediate scale of the new market is what makes it interesting, ranging from mass-consumer to industrial opportunities like remote assistance.” Clavier is broadly looking for two types of startups, “practical applications (e.g. Focal Systems) and visionary tech where use cases and business models will evolve (e.g. CV/neural network on a chip stealth startup).”

Gene Munster, Loup Ventures

As a long-time Apple analyst, Loup Ventures Founder/Managing Partner Gene Munster has similar views to Digi-Capital on how mobile AR could evolve as a long-term bridge to smart glasses. “We see 2020 as the breakout year for AR, with rear-facing AR depth sensors in iPhones in 2018 and Apple smart glasses in 2019” (note: Digi-Capital’s more conservative base case is 2019 for iPhone rear-facing AR depth sensors and 2020 for iPhone tethered smart glasses).

As a long-time Apple analyst, Loup Ventures Founder/Managing Partner Gene Munster has similar views to Digi-Capital on how mobile AR could evolve as a long-term bridge to smart glasses. “We see 2020 as the breakout year for AR, with rear-facing AR depth sensors in iPhones in 2018 and Apple smart glasses in 2019” (note: Digi-Capital’s more conservative base case is 2019 for iPhone rear-facing AR depth sensors and 2020 for iPhone tethered smart glasses).

Munster co-founded Loup because he sees “AR as the next way that humans interact with machines, with investment opportunities in business apps, games, location-based AR (i.e. AR cloud) and medical sectors.” His investment thesis revolves around both short-term exits as well as long-term platform plays, “because it is such an early-stage market, we’re starting with app companies that can demonstrate traction, and, if they get it right, leverage that success to become dominant platforms.”

Richard Tapalaga, Qualcomm Ventures

Qualcomm Ventures Director Richard Tapalaga highlights Qualcomm’s commitment to moving the underlying technology and sensors forward to enable the AR ecosystem. “Based on our deep institutional knowledge of mobile/AR/VR hardware and software, we are excited to further the ecosystem and have committed to a smart glasses future with investment such as Magic Leap. Mobile AR and CV/ML are strong interests for us, from seed through late-stage investments. Developers are flocking to mobile AR because it has scale now (unlike VR), we all know what mobile traction looks like, and there is no distribution fragmentation (again, unlike VR). That reduces the barriers to entry for VCs, because in many ways we’re on solid ground.”

Director Richard Tapalaga highlights Qualcomm’s commitment to moving the underlying technology and sensors forward to enable the AR ecosystem. “Based on our deep institutional knowledge of mobile/AR/VR hardware and software, we are excited to further the ecosystem and have committed to a smart glasses future with investment such as Magic Leap. Mobile AR and CV/ML are strong interests for us, from seed through late-stage investments. Developers are flocking to mobile AR because it has scale now (unlike VR), we all know what mobile traction looks like, and there is no distribution fragmentation (again, unlike VR). That reduces the barriers to entry for VCs, because in many ways we’re on solid ground.”

Tapalaga is investing in “core technology across cameras, sensors, ML, CV and AI. We’re also focused on mobile AR, particularly in the enterprise markets around business processes, healthcare, B2B and industrial applications. Consumer mobile AR startups doing something genuinely novel — native mobile AR, not just ports from other platforms — are also of interest to us. We prefer platforms built on top of ARKit and ARCore, much in the same way that Unity was built out on top of iOS and Android.” Tapalaga sees overinvestment as a risk, with the potential for “overfunding of startups during the early mobile AR market.”

Nabeel Hyatt, Spark Capital

Spark Capital Partner Nabeel Hyatt sees “the camera as an enabling technology similar to GPS. It’s very different to innovations like the app store or Facebook, which were all about distribution. The combination of AR, camera and ML on phones represents fundamental innovation for new products and use cases, but it could take two to three years for creators to figure out what really works. If you think of the iPhone launching in 2007 and Uber launching in 2009, that wasn’t the first use case folks thought about.”

Partner Nabeel Hyatt sees “the camera as an enabling technology similar to GPS. It’s very different to innovations like the app store or Facebook, which were all about distribution. The combination of AR, camera and ML on phones represents fundamental innovation for new products and use cases, but it could take two to three years for creators to figure out what really works. If you think of the iPhone launching in 2007 and Uber launching in 2009, that wasn’t the first use case folks thought about.”

“ARKit is the next extension of what we want to do with our phones, putting them in context with the real world. AR will become ubiquitous over time.” Hyatt thinks the broader CV/ML opportunity is at the stage where huge value creation is happening, because “we’re already four years into the cycle. We’re just as passionate about the mobile AR space, but that market’s only a couple of months old.”

Niko Bonatsos, General Catalyst

General Catalyst Managing Director Niko Bonatsos met with hundreds of VR companies in the last few years, but thinks “the short to mid-term is hard for consumer VR companies because the friction is too high.” Conversely, he is interested in investing in mobile AR startups as he believes “they are part of the future of media investing that will culminate in smart glasses. It opens up the possibility for new use cases that haven’t existed before, and is also a big opportunity for established IP holders, particularly with games spin-offs.”

Managing Director Niko Bonatsos met with hundreds of VR companies in the last few years, but thinks “the short to mid-term is hard for consumer VR companies because the friction is too high.” Conversely, he is interested in investing in mobile AR startups as he believes “they are part of the future of media investing that will culminate in smart glasses. It opens up the possibility for new use cases that haven’t existed before, and is also a big opportunity for established IP holders, particularly with games spin-offs.”

However, Bonatsos doesn’t see the path forward as smooth just yet. “Apple’s update of the app store to better promote developers is great, but distribution remains a bottleneck. Incumbent mobile players have a huge advantage over mobile AR newcomers, so the platforms need to take discovery further. Also, the first wave of mobile AR apps are largely derivative of related sectors rather than native mobile AR, and there’s also the physiology of UX to figure out. People don’t hold their phones up in front of their faces for long periods of time, so apps with high frequency, short sessions might prove successful.”

Jacob Mullins, Shasta Ventures

Shasta Ventures Partner Jacob Mullins leads the firm’s new Camera Fund to support startups “bridging the digital and physical worlds by combining smartphone cameras with CV/ML. Mobile AR’s installed base is in the hundreds of millions right off the bat, so we’re focused on scale opportunities in social, games and messaging/communications. We’re most excited about native mobile AR startups, rather than folks pivoting existing apps into mobile AR.”

Partner Jacob Mullins leads the firm’s new Camera Fund to support startups “bridging the digital and physical worlds by combining smartphone cameras with CV/ML. Mobile AR’s installed base is in the hundreds of millions right off the bat, so we’re focused on scale opportunities in social, games and messaging/communications. We’re most excited about native mobile AR startups, rather than folks pivoting existing apps into mobile AR.”

Tim Haley, Redpoint Ventures

Redpoint Ventures Founder/Managing Director Tim Haley incubated Jaunt out of their Sand Hill Road offices, and sees AR/VR as “a continuum of media types to augment our world with rich media across most sectors. We needed to go through the first phase of the market with VR over the last few years to get to the new medium. Today we’ve got 3D content blended with the real world via mobile AR user interfaces at scale. But even with that progress, we’re still at the earliest stages of what the market will ultimately become.”

Redpoint Ventures Founder/Managing Director Tim Haley incubated Jaunt out of their Sand Hill Road offices, and sees AR/VR as “a continuum of media types to augment our world with rich media across most sectors. We needed to go through the first phase of the market with VR over the last few years to get to the new medium. Today we’ve got 3D content blended with the real world via mobile AR user interfaces at scale. But even with that progress, we’re still at the earliest stages of what the market will ultimately become.”

With a core AR/VR focus on Jaunt’s evolution (some of which is still under wraps), Haley is patient about where the next big opportunity will come from in the space. “Understanding what is in the domain of the platforms and what is in the domain for startups is key, and right now we’re seeing interesting platform opportunities across different parts of the stack. From a vertical perspective, we’ve been looking in medical, education, industrial and architecture/construction. We like to invest in hard solutions to hard problems.”

Kevin Spain, Emergence Capital

Emergence Capital General Partner Kevin Spain focuses on emerging platforms in the enterprise/cloud space, so for mobile AR is looking for “enterprise use cases that are genuinely useful for business, rather than innovation or pilot research projects. It’s still really early, so we genuinely don’t know the killer applications for enterprises yet. We love companies that deliver real value to enterprises, like portfolio company IrisVR.”

General Partner Kevin Spain focuses on emerging platforms in the enterprise/cloud space, so for mobile AR is looking for “enterprise use cases that are genuinely useful for business, rather than innovation or pilot research projects. It’s still really early, so we genuinely don’t know the killer applications for enterprises yet. We love companies that deliver real value to enterprises, like portfolio company IrisVR.”

Ori Inbar, Matt Miesnieks and, Tom Emrich, Super Ventures

Super Ventures Founders/Partners Ori Inbar (upper right), Matt Miesnieks (center left) and Tom Emrich (lower right) believe that AR represents the next computing platform after smartphones.

Founders/Partners Ori Inbar (upper right), Matt Miesnieks (center left) and Tom Emrich (lower right) believe that AR represents the next computing platform after smartphones.

“Now is the time to invest in the enablers of AR, particularly bionic vision (smart glasses tech, including display and connectivity), 3D-ifying the world (computer vision and AR cloud), world building (AR/VR world-building tools), natural I/O and interaction (peripherals and natural UI), telepresence (social and communication) and super-intelligence (to make us smarter, faster and better).”

“Now is the time to invest in the enablers of AR, particularly bionic vision (smart glasses tech, including display and connectivity), 3D-ifying the world (computer vision and AR cloud), world building (AR/VR world-building tools), natural I/O and interaction (peripherals and natural UI), telepresence (social and communication) and super-intelligence (to make us smarter, faster and better).”

However, the partners are cautious on market timing, “especially in the consumer space. We don’t buy into the hype cycle, but think long-term potential is under-appreciated.”

However, the partners are cautious on market timing, “especially in the consumer space. We don’t buy into the hype cycle, but think long-term potential is under-appreciated.”

Gavin Teo, B Capital

B Capital Partner Gavin Teo is “interested in CV for both enterprise and consumer businesses. CV/ML/AI will generate tens of billions of dollars of enterprise value by the end of the decade. Digi-Capital, the leading advisory firm for AR/VR, forecasts mobile AR to be just as big. With major players like Apple, Google and Facebook driving an emerging ecosystem to support innovation and new business models, it’s the sort of market that suits VC investment really well.”

Teo believes “CV could produce some of the next great tech companies, particularly in autonomous driving. A vision-first approach adopted by Tesla and others, instead of the LiDAR-focused approach, taken by Waymo and Uber, will prove more scalable over time. For self-driving purposes, understanding what something means is more impactful than just recognizing there is something in the way.” He also thinks the macro environment will drive “M&A and venture activity within AI/ML/CV and AR businesses that sell to enterprise.”

Teo believes “CV could produce some of the next great tech companies, particularly in autonomous driving. A vision-first approach adopted by Tesla and others, instead of the LiDAR-focused approach, taken by Waymo and Uber, will prove more scalable over time. For self-driving purposes, understanding what something means is more impactful than just recognizing there is something in the way.” He also thinks the macro environment will drive “M&A and venture activity within AI/ML/CV and AR businesses that sell to enterprise.”

Phil Sanderson, Ridge Ventures (formerly IDG Ventures)

Ridge Ventures (formerly IDG Ventures) Founder/Managing Director Phil Sanderson is interested in “mobile AR experiences that are fun and engaging like Snapchat and Pokémon GO. Unlike VR, phones that enable AR are ubiquitous and supported by Apple and Google, so the ability for a company to reach escape velocity quickly is high.”

(formerly IDG Ventures) Founder/Managing Director Phil Sanderson is interested in “mobile AR experiences that are fun and engaging like Snapchat and Pokémon GO. Unlike VR, phones that enable AR are ubiquitous and supported by Apple and Google, so the ability for a company to reach escape velocity quickly is high.”

Sanderson has two mobile AR investments already, including public company Next Games, which doubled its market cap after announcing a mobile AR game based on The Walking Dead. The firm’s mobile AR focus is “entertainment software, but also industrial applications. Mobile publishers and enabling technologies are sweet spots for us.”

Amitt Mahajan, Presence Capital

Presence Capital Founder/Managing Partner Amitt Mahajan believes that “in order for computers to deliver additional information about the world around us, they first need to understand the world around us. Most of our early AR investments were focused on CV and companies trying to build the ‘Shazam of X.’ The next big companies in mobile AR could help people perform tasks that were previously outside of their skill set or knowledge area. For example, our portfolio company Scope AR allows someone non-technical to perform a technical task, like performing maintenance on an engine, by following step-by-step instructions using an AR camera.”

Founder/Managing Partner Amitt Mahajan believes that “in order for computers to deliver additional information about the world around us, they first need to understand the world around us. Most of our early AR investments were focused on CV and companies trying to build the ‘Shazam of X.’ The next big companies in mobile AR could help people perform tasks that were previously outside of their skill set or knowledge area. For example, our portfolio company Scope AR allows someone non-technical to perform a technical task, like performing maintenance on an engine, by following step-by-step instructions using an AR camera.”

Focused on enterprise, infrastructure and B2B businesses, Mahajan is interested in “companies that are building missing AR infrastructure (such as the AR cloud) or companies using AR to help people learn or be more productive at their jobs.” Because of potential UI and distribution challenges, Mahajan sees mobile AR as a stepping stone on the way to smart glasses transforming “core apps such as messaging, mail, calendar, maps, etc.”

Guillaume Payan, Orange Silicon Valley

Photo by Colson Griffith Photography

Orange Silicon Valley Principal Guillaume Payan believes that “all industries will be impacted by AR technologies. The technology has the potential to fundamentally transform the way we behave and interact, much as the smartphone already has because AR allows for a more integrated experience with our senses. There is no doubt large companies will emerge.”

Given Orange’s position as a telco, Payan explains how Orange is “making our networks deliver higher bandwidth and lower latency so that AR experiences can be frictionless. We are interested in any technology, service and product that connects people and organizations.”

Phil Chen, Horizons Ventures and Presence Capital

Horizons Ventures Advisor and Presence Capital Managing Director Phil Chen was a key driver for premium VR when he worked at HTC, but has questions about the coming evolution of mobile AR in China. “No Chinese company has succeeded in building a platform like iOS or Android, so it isn’t clear if a successful Chinese competitor to ARKit and ARCore will emerge. The player with the greatest potential is Tencent leveraging WeChat, and to a lesser extent Netease in the games space.” Perhaps because the domestic mobile AR platform market is still fluid, Chen hasn’t seen huge excitement amongst Chinese developers yet (unlike outside China).

Advisor and Presence Capital Managing Director Phil Chen was a key driver for premium VR when he worked at HTC, but has questions about the coming evolution of mobile AR in China. “No Chinese company has succeeded in building a platform like iOS or Android, so it isn’t clear if a successful Chinese competitor to ARKit and ARCore will emerge. The player with the greatest potential is Tencent leveraging WeChat, and to a lesser extent Netease in the games space.” Perhaps because the domestic mobile AR platform market is still fluid, Chen hasn’t seen huge excitement amongst Chinese developers yet (unlike outside China).

Vab Goel, Norwest Venture Partners

Norwest Venture Partners General Partner Vab Goel is “excited about AR and VR, but VR will take longer to become mainstream because it requires specialized equipment.” Goel is interested in mobile AR because of “device ubiquity, great UX and ROI potential,” and sees “CV as the key enabling technology to realize AR’s potential.” He is interested in startups coming out of and focused on mobile games, e-commerce, image search, home security, autonomous driving, enterprise and robotics sectors, and believes “AR & VR technology will have positive impact on our day-to-day lives both at work and home.”

General Partner Vab Goel is “excited about AR and VR, but VR will take longer to become mainstream because it requires specialized equipment.” Goel is interested in mobile AR because of “device ubiquity, great UX and ROI potential,” and sees “CV as the key enabling technology to realize AR’s potential.” He is interested in startups coming out of and focused on mobile games, e-commerce, image search, home security, autonomous driving, enterprise and robotics sectors, and believes “AR & VR technology will have positive impact on our day-to-day lives both at work and home.”

Alvin Wang Graylin, HTC

HTC Vive ’s Alvin Wang Graylin invested heavily in VR, which he is supplementing with AR investment, “as we see AR and VR merging in coming years. Mobile AR is bringing a new group of developers into immersive computing, many of whom could migrate from mobile to premium platforms. We see hybrid experiences developing with users interacting across AR and VR platforms.” Graylin is looking at applications in industry verticals, UGC, AI and ML/CV. “We see new products emerging in 2018, 5G helping to scale usage in 2019, with 2020 as the inflection point for more advanced AR/VR platforms. But as always, content is king and will scale the market.”

’s Alvin Wang Graylin invested heavily in VR, which he is supplementing with AR investment, “as we see AR and VR merging in coming years. Mobile AR is bringing a new group of developers into immersive computing, many of whom could migrate from mobile to premium platforms. We see hybrid experiences developing with users interacting across AR and VR platforms.” Graylin is looking at applications in industry verticals, UGC, AI and ML/CV. “We see new products emerging in 2018, 5G helping to scale usage in 2019, with 2020 as the inflection point for more advanced AR/VR platforms. But as always, content is king and will scale the market.”

Marco DeMiroz, The Venture Reality Fund

The Venture Reality Fund Co-founder/General Partner Marco DeMiroz believes “mobile AR app economics and growth prospects are similar to smartphone apps, which will be enhanced by future expansion to smart glasses.” DeMiroz sees “CV/ML as crucial to creating compelling XR for both consumer and enterprise users,” and is interested in investing in “mobile AR for consumers and enterprises, tools and infrastructure (including CV/ML,) and AR/MR/VR more broadly.”

Co-founder/General Partner Marco DeMiroz believes “mobile AR app economics and growth prospects are similar to smartphone apps, which will be enhanced by future expansion to smart glasses.” DeMiroz sees “CV/ML as crucial to creating compelling XR for both consumer and enterprise users,” and is interested in investing in “mobile AR for consumers and enterprises, tools and infrastructure (including CV/ML,) and AR/MR/VR more broadly.”

Other views

Maven Ventures Founder/Managing Partner Jim Scheinman (right) is still looking for the billion-dollar idea for consumers when it comes to mobile AR, but has already invested actively in the autonomous driving market.

Founder/Managing Partner Jim Scheinman (right) is still looking for the billion-dollar idea for consumers when it comes to mobile AR, but has already invested actively in the autonomous driving market.

Comcast Ventures Managing Director Michael Yang (left) doesn’t know if the “next big thing” will come out of mobile AR given the nascent market and limited monetization, but is hopeful given its potential scale.

Comcast Ventures Managing Director Michael Yang (left) doesn’t know if the “next big thing” will come out of mobile AR given the nascent market and limited monetization, but is hopeful given its potential scale.

Traction, traction, traction

Almost every VC I spoke to mentioned the next 12 to 18 months as a critical time for startups in this space. Mobile AR’s scale-distribution platforms and CV/ML’s real-world applications mean that traction is easy to compare to established benchmarks in mobile or enterprise apps more broadly. VCs are looking for genuine disruption from their frontier tech investments, and this market is no different.

No pressure there then.

(Thanks to Greycroft Venture Partner Jon Goldman and Venrock Investor Adam Wang-Levine for their contributions to this post.)