For anyone who’s ever wanted to break a lease, but felt trapped by their contract, Flip has the service for you.

The company, which allows users to sublet or get out of their lease, has just raised $2.2 million in new financing to grow its business and is looking to expand beyond its suite of offerings to renters in San Francisco, Los Angeles and New York.

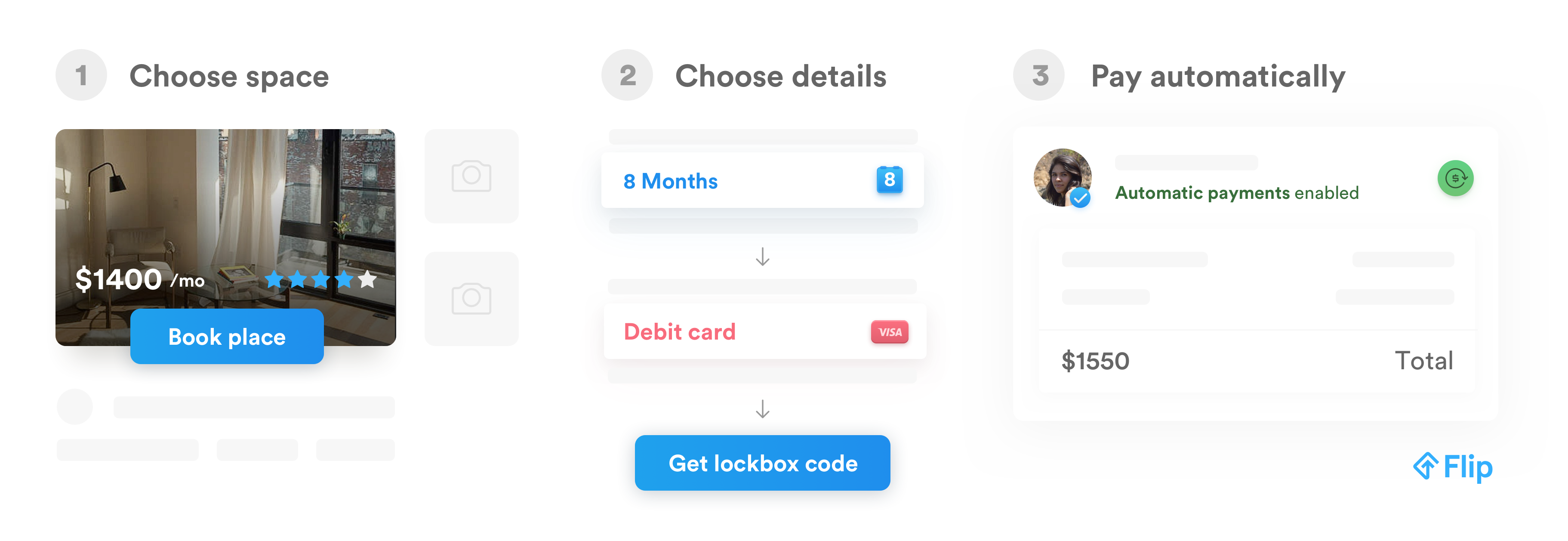

Vila said Flip is developing in-app payments, rent guarantees and generic legal documents to streamline the subletting process.

“The idea behind why we built it is that people’s lives never fit into a 12-month time period,” says company chief executive Susannah Vila. “The nature of the people who are using us are people who want that flexibility.”

The New York-based company was born out of the desperation of its CEO. While attending grad school at Columbia, Vila found herself desperately searching for a way out of a living situation with an ex-boyfriend.

The two shared an apartment, and Vila found herself with no way to get out of the lease.

So, Flip was born.

Flip chief executive Susannah Vila with chief technology officer Roger Graham

The company, a graduate of the Techstars NYC accelerator (as a Techstars mentor, I gave the company some advice on pitching journalists two years ago and haven’t heard from them until they raised this round), works just like any other online housing listing service — without many of the legal hurdles that have gotten Airbnb into trouble.

The whole point of Flip is to facilitate legally subletting an apartment for a long-term stay. It gives renters greater flexibility, and offers landlords a level of security, Vila says. Average Flip leases typically come in at about six months, but the agreements can range anywhere from three months to a full year.

Flip handles credit checks and assures that a would-be tenant can afford the lease they’re looking to take over.

Already 15 percent of the company’s listings are coming directly from landlords, with the rest coming from individual leaseholders.

In some ways, it’s the antithesis to the co-living spaces that have come up to try to address the needs of the nomadic no-collar worker created by a freelance and gig-driven modern economy.

“On the very, very short term there’s Airbnb, and on the long-term side there’s ad-supported lead generation marketplaces like Zillow,” says Vila. “There’s nothing in-between those two platforms.”

Vila contends that trying to book long-term on Aribnb will get someone a markup of three times the cost of just taking over a new lease agreement from an existing tenant.

The company’s fresh cash injection came from Union Square Ventures, Techstars New York City and Collaborative Fund.

Flip had previously raised $1.2 million from Joanne Wilson, Scott Belsky, Techstars Ventures, Built by Girls Ventures (which is backed by TechCrunch-owner AOL), V1 Ventures and MetaProp NYC.