Data-driven investor community TradingView has hit one million monthly active users and is expanding globally to under-served markets. TechCrunch last covered TradingView in 2012 when the site was seeing 2,000 visitors per day.

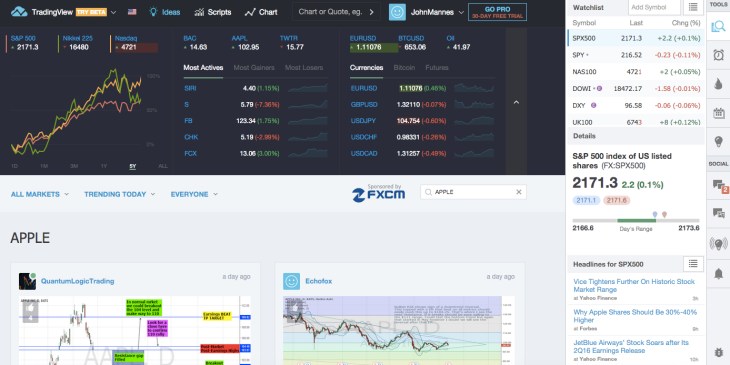

The site differs from other investor communities like Seeking Alpha because of its emphasis on visuals. TradingView takes a chart based approach to supporting investing. The community shares, critiques, and builds upon investing ideas presented as charts.

TradingView has aligned itself well with fintech democratization market trends. Its free market-data is accessible from any device in countries that include Russia, Spain, and Brazil. Fellow democratizer Robinhood launched its zero-fee stock trading app in 2013 to much fanfare. The app opens up stock trading to customers that were previously cut-out by trading-fees that ate into profits. Robinhood has gone on to raise $66 million in venture financing.

Stan Bokov, co-founder and COO of TradingView, believes education is one of the site’s strongest assets.

Like Twitter, TradingView lets users message and follow others with good ideas. It also keeps a permanent record of every claim made on the platform. This way you’ll never forget who was responsible that time you totally didn’t buy into the Facebook IPO (or bought into Twitter).

Continuing the Twitter comparison, a majority of people are exposed to the site through widgets on other sites powered by TradingView. You’ve likely seen TradingView content on sites like Investopedia.

These 15 million non-users are funneled to the site where they have the option of upgrading to a premium subscription. Bokov notes that the average user doesn’t need to upgrade, but those looking for more advanced features have access to monthly subscription plans that come in at $10 for Pro, $20 for Pro-plus, and $40 for Premium.

All subscription plans remove ads and let users subscribe to real-time data feeds. The pro-plus plan provides extended trading hours, unlimited server-side alerts, and additional chart types. Premium subscribers get access to dedicated email and phone support.

Market data feeds like NASDAQ, NYSE, and NYMEX range in price between $2 per month and $90 per month. The free tier provides access to 16 basic data packages including BATS and CBOE options data. In addition to tiered subscriptions, TradingView also has a web-store where users can purchase access to third-party tools like sentiment analysis.

The dedicated community is growing at 10 percent per month, organically, without any direct advertising. Also notable for TradingView is how it has been able to scale to 100 employees with only $3.75 million in funding and a $3 million revenue run rate. The answer lies in creative outsourcing. While TradingView has representatives all around the globe, the company’s 70 person engineering team is located in Eastern-Europe. This has kept costs down while enabling the company to efficiently scale globally.

Continuing to push into under-served markets is the primary goal for Bokov as the company grows and nurtures its investing community