On-demand transportation company Uber is working on ways that it could make life easier for its drivers. Earlier today, that included a partnership with Metromile to offer per-mile car insurance. And now the company is announcing a partnership with Intuit that could provide more visibility to drivers about their earnings and taxes.

Yesterday we wrote about how Stripe and Intuit were partnering to help a large number of on-demand workers keep track of their incomes. Since a number of newer on-demand service startups (like Lyft, Handy and Homejoy) use Stripe to make payments, the partnership would enable their workers to use Intuit’s free QuickBooks Online Self-Employed software to manage their earnings and finances.

But that partnership didn’t benefit Uber drivers. That’s because Uber, which is probably the largest (and fastest-growing) employer of contract workers in the on-demand economy, doesn’t use Stripe for payments.

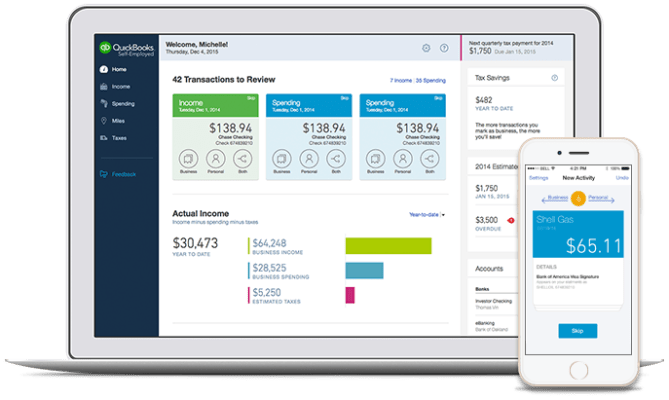

Well that problem has now been solved. Thanks to the partnership, Uber drivers will be able to import their earnings into the QuickBooks software, and also use it to track mileage, tolls, gas payments and other expenses that can be deducted come tax time.

Through the partnership, Uber drivers will not only have access to free services that QuickBooks offers, but also premium features like adding credit card or bank accounts and the ability to categorize their deductibles. That will give drivers a better view of their gross earnings and tax liabilities. And since tax day is right around the corner, now is a good time for them to start thinking about that.